Latest from IPE Magazine – Page 36

-

Country Report

Swiss retirement is becoming more flexible

Swiss pension funds are starting to offer members greater flexibility in how they access their retirement savings in their old age

-

Special Report

Special ReportWho decides if investors can pursue sustainability objectives?

Pension funds must be prepared in case their members don’t care about sustainability

-

Special Report

Special ReportInvestors’ climate lobbying turns from corporates to sovereigns

Engagement efforts with companies on climate issues have fallen short, and investors are now raising the stakes by lobbying governments on climate policy

-

Special Report

Special ReportSustainable finance professionals take stock

IPE asked the responsible investment leads of top European asset owners a key question: has the ESG / green finance movement been effective in achieving a more sustainable economy? Here are their answers

-

Special Report

Special ReportNatural capital and biodiversity: betting on disclosure for nature

The Taskforce on Nature-related Financial Disclosures (TNFD) has taken a pragmatic approach to developing its final recommendations

-

Opinion Pieces

Opinion PiecesIreland – future pensions tiger

Ireland stands a few policy steps away from the creation of a serious first and second-pillar pensions architecture that will improve the country’s international standing in terms of retirement provision.

-

Analysis

AnalysisTrust will matter in light of market dominance of UBS in Swiss institutional business

One of the most important aspects of the downfall of Credit Suisse and the subsequent takeover by UBS is that loss of trust comes at the highest possible cost

-

Analysis

AnalysisAccounting standards: stuck between practicalities and principles on climate change

The International Accounting Standards Board is considering changing its rules on how companies make disclosures about climate-related and other so-called uncertainties in financial statements

-

Analysis

AnalysisThe pension consolidation masters: learning from the Netherlands

What can other countries learn from the Netherlands about pension fund consolidation?

-

Features

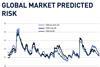

FeaturesMarket volatility: low risk does not mean ‘no risk’

Efforts to produce an accurate estimate of market risk can sometimes turn into a pessimist’s paradise, leading to a paradox. If the outcome of the estimation looks positive, investors might feel that they should not count on it, and if it looks negative, the real outcome will probably be worse than expected. From that perspective, the third quarter of this year was a very unusual one, quantitatively speaking. Not only did both risk and return decline simultaneously – a rare event – but investor sentiment also turned negative during the quarter, ending at its lowest level since the March banking crisis.

-

Features

FeaturesFixed income, rates & currency: interest rates the big question

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

-

Features

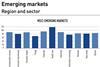

FeaturesQontigo Riskwatch – November 2023

*Data as of 29 September 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Opinion Pieces

Opinion PiecesRegulation of private markets is essential

The private markets industry is feeling the pinch. Private equity managers, in particular, are having a hard time raising capital and exiting investments. There are also questions about returns from recent vintages, as businesses struggle with inflation and a choppier trading environment. Meanwhile, private credit managers are pushing back loan repayments to safeguard returns as higher interest rates reduce borrowers’ ability to fulfil their obligations.

-

Opinion Pieces

Opinion PiecesIrish pensions auto-enrolment is a worthy challenge

Irish citizens are set to get a retirement boost following the government’s decision to implement its auto-enrolment retirement savings scheme in 2024. That is, if all goes to plan. Under the proposed scheme, which has been a topic of debate in Irish politics for at least 15 years, employees will have access to a workplace pension savings scheme that is co-funded by their employer and the state.

-

Interviews

InterviewsPrivate equity managers are keeping pension funds happy – in most cases

The private equity industry faces significant pressures. IPE asked Nordic pension funds about their experience with this growing asset class.

-

Features

FeaturesPricing the decline of democracy for investors

History does not progress in a linear way. Science, democracy, technology, arts, the economy and any other type of evolutive process advance and recede in chaotic movements, even though they ineluctably move towards progress. Those recessions and pull-backs often go unnoticed at first, at least to the casual observer. And yet, they end up profoundly sanctioned by all stakeholders including the economy, financial markets and investors.

-

Interviews

InterviewsReal assets at the core for Migros Pensionskasse

Christoph Ryter (pictured left) and Stephan Bereuter of Switzerland’s Migros Pensionskasse tell Luigi Serenelli about the fund’s asset allocation strategy and guiding sprit of self reliance

-

Features

FeaturesRegulators set sight on private market fund valuations

The current waves of rising inflation and interest rates, economic uncertainty and market volatility may eventually be remembered as just a temporary setback for managers of unlisted assets. But the regulatory initiatives announced in recent months, following pressure from investors and the public, could bring about deeper changes to the buoyant private markets industry.

-

Interviews

InterviewsOpening private markets to smaller investors

“One of the biggest differentiators for us in comparison to other private markets businesses is our focus on the use of technology within the business,” says Hartley Rogers, chair of Hamilton Lane.