Latest from IPE Magazine – Page 40

-

Special Report

Special ReportHow investors are positioned to capitalise in APAC private markets

Strong fundamentals and a lack of correlation with western markets make the region particularly attractive

-

Country Report

Country ReportNew pension rules set to transform France

After much opposition, profound changes to the retirement system take effect this month

-

-

Special Report

Special ReportInvestors take a cautious asset allocation path on Asia

Investing in the region is far from straightforward, with benchmarking particularly tricky

-

Special Report

Special ReportIndustry awaits final advice on IORP II review

Pension groups want EIOPA to consider how its sustainability-related proposals would interact with the SFDR

-

Country Report

Country ReportFrance moves ahead with innovative climate reporting rules

A new French law could compel companies to disclose their climate plans

-

Country Report

Country ReportFrance’s new pension product smashes through target

Assets managed by PER supplementary pension products could reach €200bn by 2026

-

Special Report

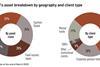

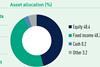

India forms cornerstone of GIC’s BRIC portfolio

The Singaporean sovereign wealth fund has invested billions in the subcontinent since the 1990s and considers the country under-invested

-

Special Report

Special ReportAustria: Pension industry faces an indifferent government

Reforms look likely to be on hold until after federal elections in 2024

-

Special Report

Special ReportSumitomo Mitsui Trust's Yoshio Hishida on Japan's unique position to attract investment

Yoshio Hishida, CEO of Sumitomo Mitsui Trust Asset Management, one of Japan’s largest investment managers, talks to Christopher Walker about his company’s focus on retail and attracting international capital

-

Special Report

Special ReportBelgium: First-pillar reform caps highest pensions

Federal government manages to work out a first-pillar agreement before the parliamentary recess

-

Special Report

Special ReportDenmark: Early retirement rules face further overaul

Arne, a new regime to allow workers in strenuous jobs to retire early may be merged with a more popular scheme

-

Special Report

Special ReportFinland: Stabilising the level of pension insurance contributions

Government programme sets out to find ways to stabilise the level of pension insurance contributions over the long term

-

Special Report

Special ReportFrance: Macron’s major pension reforms take effect

September sees the enactment of controversial retirement reforms passed by presidential decree earlier this year, bringing 42 occupational regimes together

-

Opinion Pieces

Opinion PiecesEurope escaped the Great Retirement Boom but watch out for the crunch

Continental Europe appears to have largely escaped the trend known in the US as the ‘Great Retirement Boom’, where an economically comfortable cohort of 50 to 64-year-olds has retreated from work in the post-COVID period.

-

Features

FeaturesFossil fuel divestment is back in fashion

More and more asset owners are exiting oil and gas. Sophie Robinson-Tillett speaks to some about why, and how, they’re selling out of the sector

-

Opinion Pieces

Opinion PiecesHow to improve investment committees

Most asset management firms, private and public institutional investors and family offices have investment committees. Poorly designed boards can potentially destroy substantial value in the investment management industry, yet little research is available. I would like to propose a new way to think about the governance of investment committees.

-

Features

FeaturesBritain’s LDI crisis: When things nearly fell apart

On 23 September 2022, Kwasi Kwarteng, the then UK chancellor of the exchequer, announced a £45bn (€52bn) package of tax cuts. The hand-outs, designed to please key voters, were the wrong gift at the wrong time. For several years, the Bank of England had been attempting to end quantitative easing and start putting a higher price on borrowing.

-

Features

FeaturesHow the AT1 bond market shrugged off the Credit Suisse debacle

On a late Monday evening in August, the Italian right-wing government unexpectedly announced a new 40% tax on banks’ ‘windfall’ profits derived by the higher lending rates. Shares in Italian banks tumbled, banking executives cried foul, and analysts poured scorn over the measure. The government, which was hoping to raise up to €3bn to help families and small businesses, backtracked shortly after, scaling back the tax.

-

Interviews

InterviewsPaul Lorentz, Manulife Asset & Wealth Management: Canada to Europe, via Asia

Values are changing rapidly in the world of asset management. Leaders come and go, but perhaps less so than in the past, and loyalty to a company is increasingly appreciated by clients, as a sign of commitment and stability.