Latest from IPE Magazine – Page 41

-

Features

FeaturesResearch: The yin and yang of passive and active investing

Amin Rajan and Sebastian Schiele look at the complementary relationship between active and passive investment strategies

-

Features

FeaturesThe US dollar’s declining status as a global reserve currency

The recent US debt ceiling negotiations have brought into question the viability of the US dollar’s status as a global reserve currency. Long-term investors have been reviewing their strategic asset allocation away from the currency, seeking to diversify their exposure and to take advantage of long-term investment opportunities.

-

Interviews

InterviewsUSS: British universities adopt modern pension investment governance

Mirko Cardinale, head of investment strategy and advice at USS Investment Management, speaks to Carlo Svaluto Moreolo about the recent changes in the scheme’s governance framework

-

Opinion Pieces

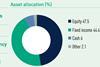

Opinion PiecesPrivate assets still a priority for pension fund investors

Investor sentiment towards private markets continues to be positive, despite the continuing challenges of higher interest rates and ongoing macroeconomic uncertainty.

-

Opinion Pieces

Opinion PiecesCambridge and Westminster: a tale of two pension schemes

The Houses of Parliament and Cambridge University are two venerable British institutions. But the differences in how they run their pension arrangements illustrate the contrast between the UK-style pooled liability-driven investment (LDI) and a more traditional form of pension investing, no longer as popular in the UK but still common elsewhere.

-

Interviews

InterviewsPension funds on the record: The investors developing their own index methodologies

FRR and PUBLICA are among the growing number of European pension funds developing proprietary benchmarks to achieve their sustainability objectives

-

Asset Class Reports

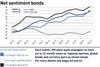

Asset Class ReportsRethinking net-zero equities benchmarks

The EU developed rules for climate benchmarks in 2019. After a surge in uptake, investor sentiment is already cooling

-

Opinion Pieces

Opinion PiecesResistance to Germany’s new buffer fund proposal

Last year, the manager of Germany’s pay-as-you-go first-pillar scheme, Deutsche Rentenversicherung, recorded income of €363bn, the largest share coming from contributions (€275.6bn), and €87.4bn in public subsidies.

-

![RobertGEcclesPhoto[1]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/8/2/3/142823_robertgecclesphoto1_404467_crop.jpg) Opinion Pieces

Opinion PiecesESG remains mired in politics in the US

“I am not going to use the word ESG because it’s been misused by the far left and the far right,” said BlackRock CEO Larry Fink in a conversation at the Aspen Ideas Festival in June.

-

Special Report

Special ReportGermany: Fighting for innovation

The three-party coalition faces important decisions in coming months to reconcile differences over its planned reforms to all three pillars of the pension system

-

Features

FeaturesPancakes for lunch with Nobel laureate Harry Markowitz

Harry Markowitz, Nobel Laureate and founder of Modern Portfolio Theory, passed away in June this year. Much has been written about his contribution to the development of modern finance theory. Less, though, on Harry as a person.

-

Features

FeaturesISSB: Green future or more green washing?

Imagine a world where investment professionals can make decisions based on standardised environmental, social, and governance (ESG) data. Well, that may no longer be a pipedream, thanks in no small part to the publication on 26 June of the International Sustainability Standards Board’s (ISSB) board’s first two sustainability reporting standards.

-

Features

FeaturesOpen-ended investment funds face up to the shadow banking dragnet

The debate over the systemic risk of non-bank financial institutions (NBFIs) – sometimes called shadow banks – is a recurrent theme but it has recently moved to the forefront thanks to tighter monetary policies, geopolitical risks and factors such as the UK’s LDI crisis. While regulators are assessing the threats posed, most market participants believe changes will not happen for years. For some, there are fears that largely unleveraged segments like open-ended investment funds could be unfairly targeted

-

Features

FeaturesFixed income, rates & currency: Uncertainty persists

As the major central banks in developed markets reach, or at least near, the end of their hiking cycles, markets, rather than identifying when policy rates will peak, focus is now on the conundrum of just how long these policy peaks will be maintained.

-

Features

FeaturesQontigo Riskwatch - September 2023

*Data as of 31 July 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator: September 2023

US officials are talking up the Ukrainian advance towards Melitopol, a sign that all is not well. Contrary to expectations, the biggest problem is not the Russian air force, but land mines. Trump’s legal problems are as worrisome as his inexplicable lead among Republicans. US abstinence in the struggle against climate change is a potential cause for a major trade war as the EU realises it must expand its regulations on importing ‘dirty’ products to prevent a free rider problem undermining its climate efforts. In the UK, Labour’s lead over the Conservatives remains crushing, making it difficult to claim the government has a popular mandate.

-

Opinion Pieces

Opinion PiecesConcerns over plans for Australian super funds to provide advice

In what some see as a controversial move, Australia’s Labor government under prime minister Anthony Albanese has reformed the nation’s financial advice industry, opening the door for industry superannuation funds to offer financial advice to millions of members.

-

Special Report

Special ReportIceland: Government faces pension fund ire over housing bond controversy

Pension funds have welcomed a relaxation in foreign investment rules but would have preferred a more liberal regime

-

Special Report

Special ReportIreland: All systems go for national auto-enrolment

Irish government aims to launch auto-enrolment retirement system in 2024