Latest from IPE Magazine – Page 42

-

Special Report

Special ReportItaly: Government eyes pension reform despite lack of resources

Giorgia Meloni’s right-wing government wants to lower retirement age and secure retirement income for young workers, but it faces an uphill battle against inflation

-

Special Report

Special ReportNetherlands: Pension funds to switch to DC by 2028

Long-awaited transition to happen despite complications of the Dutch pension system

-

Special Report

Special ReportNorway: Public-sector pensions consultation set for autumn

Occupational pensions could form part of a new review following last year’s Pension Commission report

-

Special Report

Special ReportPortugal: Social security surplus funds pension boost

The Socialist government aims to reduce pensioner poverty but faces considerable demographic hurdles

-

Special Report

Special ReportSpain: New regulation introduces lifestyling

Government pushes through legislation package before elections last July

-

Special Report

Special ReportSweden: FTN’s large mandate overshadows Alecta’s position

Government authority sets out first tender in its bid to ensure pension funds access to quality funds to provide safer and higher pensions

-

Special Report

Special ReportSwitzerland: Heated debate ahead of second-pillar referendum

The workplace pension system reform must clear the final hurdle of a national referendum and Pensionskassen will have to start to follow new guidelines on ESG

-

Special Report

Special ReportUK: Encouraging UK growth through consolidation

The UK government is pursuing plans to leverage pension assets to boost economic growth while generating best returns for members

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Fixed income & credit

Factors including rising inflation and interest rates, the war in Ukraine, and the uncertainty surrounding the global economy might have significantly slowed down the growth of an alternative asset class like private debt. But this has not been the case, and while fundraising by private debt managers for 2022 and 2023 might be challenging, investors are making new long-term commitments.

-

Opinion Pieces

Opinion PiecesCapital competition: where does it leave sustainability goals?

For pension funds and other similar large institutional pools of capital, there is significant pressure from politicians to invest in politically favoured domestic sectors – like renewables or high-growth sectors like venture capital.

-

Country Report

Country ReportCountry report – Pensions in Italy (July/August 2023)

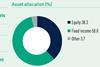

Italian second-pillar occupational pension funds continue on their path to diversification. Owing to the higher yields on offer in traditional fixed income markets, allocations to private markets may slow down temporarily, but funds have made long-term strategic commitments. A variety of industry initiatives is facilitating investment in private equity, private debt and infrastructure. Meanwhile, some pension funds are consolidating their private markets portfolios.

-

Asset Class Reports

Asset Class ReportsFixed income & credit – No turning back for alternative credit

Investor demand for alternative lending strategies remains strong as the opportunity set grows

-

Country Report

Country ReportItaly: Private markets allocations at a crossroads

Italian pensions funds are showing renewed interest in fixed income, as investment in private markets slows down – but long-term commitments are still in place

-

Opinion Pieces

Opinion PiecesLessons learned from Berlusconi’s pension reforms

To some, the death of Silvio Berlusconi on 12 June this year, is the end of an era for Italian politics. Berlusconi was the longest-serving prime minister in the history of the republic and a highly controversial figure, at home and abroad. He can be described as the first modern European populist leader.

-

Country Report

Country ReportItaly: Byblos consolidates private markets portfolio

The industry-wide fund has opted for a single external multi-asset mandate for private equity, private debt and infrastructure

-

Opinion Pieces

Opinion PiecesNotes from the Nordics: NBIM still learning on equal pay after winning employment case

Norway’s sovereign wealth fund has hailed the benefits of litigation abroad to drive its corporate governance agenda. Closer to home, victory in an Oslo employment case may have rung decidedly hollow for Norges Bank Investment Management (NBIM).

-

Asset Class Reports

Asset Class ReportsFixed income & credit – Sustainability-linked bonds

Sovereigns and other issuers are yet to embrace sustainability-linked bonds but issuance is growing

-

Asset Class Reports

Asset Class ReportsFixed income & credit – Resilience bonds

Resilience bonds aim to encourage climate investment characterised by a more forward-thinking, preventative outlook

-

Country Report

Country ReportItaly: Casse di Previdenza roll with the punches

Italian industry-wide pension funds fail to attract new members, with potentially serious long-term consequences

-

Opinion Pieces

Harnessing the power of corporate governance

Pension funds and other institutional asset owners have significant influence when it comes to voting in companies’ annual general meetings (AGMs). The consequences of their voting decisions can have a profound impact on company share prices and long-term objectives, especially in the context of climate change.