Latest from IPE Magazine – Page 46

-

-

Features

FeaturesIPE Quest Expectations Indicator: June 2023

Continued loud bickering between the Wagner Group and the Russian army is protecting Putin from both, worsening the outlook for peace, while there are multiple signs that military supplies are approaching exhaustion. The coalition supporting Ukraine is stronger than ever, showing increasing willingness to provide military aircraft. Yet the offensive expected in February has not started. In the US, Florida governor Ron DeSantis is damaging his position with an unproductive row with Disney, while Trump has moved closer to a prison term. Gas consumption in the EU is falling faster than expected, due to efficiencies like heat pumps, changeover to electricity and solar panels. Macron scored nicely by sponsoring the participation of Zelensky at the Hiroshima G7; Sunak failed to centre political attention on China.

-

Opinion Pieces

Opinion PiecesAustralia: volatility stirs valuations debate

As a disconnect in the valuation of listed and unlisted assets widens in today’s volatile markets, the torchlight is again being trained on Australia’s guardians of retirement savings.

-

Country Report

Country ReportCountry Report – Pensions in UK (May 2023)

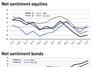

UK pensions are at a crucial juncture. The UK Parliament’s inquiry into the LDI crisis of September 2022 shed some light on its causes, but the debate on the role of LDI is alive and well. Meanwhile, regulators including The Pensions Regulator and the Financial Conduct Authority have advised pension schemes on how to make LDI strategies more resilient to shocks.

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Fixed income

Last year ushered in a new era for global fixed income and credit markets. It was the worst, in terms of returns, for bond investors in years, but it signalled a regime change. Investors need to be prepared for structurally higher inflation and rates, as well as higher volatility. But for fixed income managers, this is an environment where value is easier to find. Our report looks at this new beginning for fixed income investors, and at how selectivity has become key in the high yield and loan markets.

-

Country Report

Country ReportUK: A review of the LDI debacle

The UK Parliamentary inquiry into the LDI crisis has shed light on its causes, but the debate over the lessons learned for the UK DB industry is far from over

-

Asset Class Reports

Asset Class ReportsFixed income – New beginning for bond investors

A painful 2022 for fixed income means attractive opportunities and a possible normalisation in risk and return

-

Country Report

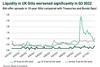

Country ReportUK: to barbell or not to barbell?

In the new world of lower LDI leverage, trustees must choose between maintaining hedging or diversification

-

Asset Class Reports

Asset Class ReportsFixed income – A year for selectivity in high yield and loans

Patience might prove the be the watchword for the rest of 2023 in high yield

-

Country Report

Country ReportUK: Can the country turn a flawed investment ecosytem around?

Decades of complex legislation has fuelled many unanticipated consequences, which has seen pension funds invest less in riskier listed equities and illiquid assets

-

Asset Class Reports

Asset Class ReportsFixed income – Europe's investment-grade market makes a comeback

Investors are showing tentative signs of interest as spreads tighten

-

Asset Class Reports

Asset Class ReportsFixed income – Convertible bonds return to favour

After a long period in the wilderness, convertible bond issuance is coming back to life

-

Country Report

Country ReportUK: Beware the unintended consequences of the DB funding code

Laura McLaren highlights the unintended consequences of TPR’s proposed code, and what can be done to mitigate the risks

-

![Ewan McCulloch (7)[33]](https://d3ese01zxankcs.cloudfront.net/Pictures/100x67/6/1/3/138613_ewanmcculloch733_634858_crop.jpg) Country Report

Country ReportUK: Is it too soon to reform pension pools?

In his March 2023 Budget, UK chancellor Jeremy Hunt challenged the Local Government Pension Schemes (LGPS) in England and Wales to “move further and faster on consolidating assets”, proposing that LGPS funds transfer all listed assets into their pools by March 2025.

-

Country Report

Country ReportUK: The case for pooling

Successful pooled schemes such as Border to Coast should be open to other clients because they are good at what they do

-

Country Report

Country ReportUK: DC investment won't be a panacea for tech and science

The UK government’s March Budget contained plans to boost investment in high-growth industries such as digital, life sciences and advanced manufacturing, so they can start, scale up and remain in the UK.

-

Opinion Pieces

Opinion PiecesLDI lessons: be wary of future traps

After the global financial crisis of 2008-09, world leaders meeting at the Pittsburgh G20 summit mandated central clearing for derivatives. This was to allow for greater supervisory oversight and to mitigate against the unintended build-up of risks of the kind that almost toppled the financial system in the guise of over-the-counter credit default swaps.

-

Opinion Pieces

Opinion PiecesBlame will not solve the issues raised by the LDI crisis

The chain of events that led to the UK’s liability-driven investment (LDI) crisis, a high-profile inquiry by the UK Parliament, and a time of anxiety and introspection in the country’s pension industry, started well before then prime minister Liz Truss’s government and its somewhat reckless ‘growth plan’.

-

Features

FeaturesAccounting: Connectivity between ISSB and IASB on accounting standards

If you think we all agreed on what connectivity is, you are probably wrong. At least that is what the International Accounting Standards Board’s vice-chair Linda Mezon-Hutter seemed to imply at a recent meeting of the IFRS Foundation’s Accounting Standards Advisory Forum (ASAF).

-

Interviews

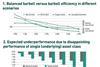

InterviewsOn the record: A new role for alternative investments for Veritas

The degree of diversification that alternative portfolios typically provide can be less than many institutions think. Veritas has reorganised its alternatives portfolio to deliver better diversification