Latest from IPE Magazine – Page 49

-

Interviews

InterviewsNikko Asset Management: Complex, creative thinking

Stefanie Drews is at home with complexity. She speaks several languages fluently, including Japanese, and tells us she still does her maths in Italian.

-

Interviews

InterviewsInterview: Hanneke Smits of BNY Mellon IM on diversity

The 30% Club started in the UK in 2010 with the ambition to raise female board representation to 30%. It is largely run as a network of volunteers, so new chair Hanneke Smits stresses the importance of having the backing of her “day job” at BNY Mellon Investment Management, where she is CEO. The investment firm was an early supporter of the club, which was co-founded by Helena Morrissey, then CEO of Newton (part of the BNY stable).

-

Interviews

InterviewsPension funds on the record: In-house due diligence of private debt managers pays off

Experienced alternative credit investors find that risk-adjusted returns are better than in the more liquid credit markets

-

Interviews

InterviewsPZU TFI: Building the future of Polish pensions

Marcin Żółtek (pictured), CEO of PZU TFI, one of Poland’s largest managers of DC pension savings, tells Jakub Janas and Carlo Svaluto Moreolo about the firm’s role in the Polish pension system

-

Opinion Pieces

Opinion PiecesBanking crisis delivers a lesson on equity strategy

We may never know the precise reasons why the in-house equity team of Alecta, the €105bn Swedish pension scheme, chose to invest in excess of €1bn in risky US banks including Silicon Valley Bank (SVB), much of which has now been written off.

-

Opinion Pieces

Opinion PiecesUS: Private equity losses weigh on pension funds

US public pension funds should brace for a big negative surprise when they prepare their reports for the fiscal year ending 30 June 2023. Only then will their returns reflect losses from 2022 in their private equity (PE) portfolios.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: LDI regulation should not ignore private asset solutions

In the aftermath of the liability-driven investing (LDI) crisis, The Pensions Regulator (TPR) in the UK drew up guidelines for pension funds to improve the resilience of LDI strategies. These guidelines primarily aim to support the creation of liquidity buffers so that pension funds can withstand yield shocks. To that end, the guidelines advise pension funds to conduct stress tests and identify suitable collateral with respect to both leveraged and unleveraged LDI strategies using yield-shock scenarios.

-

Features

FeaturesThe West should understand the strengths and limitations of Enterprise China

China is fast becoming the West’s bogeyman. Yet a hard decoupling of the two would be a lose-lose situation for both. Despite the tensions, private companies face the challenge of creating viable strategies for interactions with China that could make the difference between success and bankruptcy.

-

Features

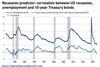

FeaturesFixed income, rates & currency: Optimism fades on mixed data

January’s market optimism has been subsiding, as forecasts for inflation and US Federal Reserve policy shift the outlook further to the hawkish side. However, the macro picture is not clear. Markets hang on to every new piece of data to clarify the outlook, be it non-farm payrolls, the consumer price index (CPI) or the US Job Openings and Labor Turnover Survey (JOLTS).

-

Features

FeaturesIPE Quest Expectations Indicator April 2023

With new, superior equipment, the Ukrainian military is set to start an offensive soon. Meanwhile, Yevgeny Prigozhin, leader of the Wagner Group, is jockeying to become Russia’s next kleptocrat on the back of the Russian army. Donald Trump’s candidacy is increasingly beleaguered by defeats in court. The trade agreement on Northern Ireland between the EU and the UK is a significant boon for both as well as for Prime Minister Rishi Sunak, not because the trade flows are so important but because the issue blocked co-operation in many other fields. While the winter has been mild and beneficial, there are early signs of a dry spring, quite possible in view of climate change setting in. If that materialises, harvests, therefore food prices, will be affected in autumn.

-

Features

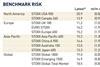

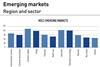

FeaturesQontigo Riskwatch – April 2023

*Data as of 28 February 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Opinion Pieces

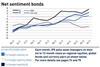

Opinion PiecesAustralia: Super funds shift to fixed income

With fear of recession in Australia and globally, superannuation funds have gone into defensive mode. Cash and liquidity are two key considerations for CIOs, and some are waiting to take advantage of attractive market opportunities.

-

Country Report

Country ReportCountry Report – Pensions in Germany (March 2023)

Angela Merkel’s governments largely dodged the political hot potato of first-pillar pension reform, which means the current overhaul to the state system is overdue. But it barely gets to grips with the issues. For one, it does not deal with entitlements or increase the retirement age; second it introduces a funded component that will probably only take effect in the 2030s, when the post-war demographic peak is passing.

-

Special Report

Special ReportSpecial Report – Natural capital

Incorporating nature risk into financial analysis remains the - for now elusive - goal for investors, but this is hard given the lack of consensus on what information should be collected and how it should be presented. Such questions are the domain of the Taskforce for Nature-related Financial Disclosures (TNFD), the group founded in 2021. As well as striving for transparency and consistency in data disclosure, asset owners are also keen to deter inflated and exaggerated claims by asset managers on biodiversity impacts.

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Private debt

The rise in interest rates and inflation throughout 2022 brought traditional fixed-income assets back into focus for investors. The threat of a recession, the pressure on investors to maintain liquidity in portfolios and the ‘denominator effect’, which sees investors over-allocated to unlisted assets after a torrid 2022 for listed equities and bonds, are all facts that would suggest that private debt markets will suffer. However, investors are still backing experienced private debt managers and allocations to the asset class are forecast to grow further in the medium term.

-

Special Report

Special ReportNatural capital: Industry turns its gaze on biodiversity

Taskforce on Nature-related Financial Disclosures sets out to create a framework to help financial institutions and companies report their dependencies and impacts on nature

-

Asset Class Reports

Asset Class ReportsPrivate debt: Managers take back control

Steady demand for private credit puts lenders in a strong position to negotiate beneficial terms, but discipline in lending remains crucial

-

Country Report

Country ReportGermany: First pillar pension reforms in need of political and financial capital

Berlin’s new ‘Generationenkapital’ concept is intended to revamp the ailing first pillar but political consensus is lacking and more capital will be necessary to endow the planned state fund

-

Country Report

Country ReportGermany: Aba's perspective on pension reforms

Klaus Stiefermann, managing director of the German occupational pension association Aba, tells Luigi Serenelli about the main proposals to change the pension system