Latest from IPE Magazine – Page 51

-

Interviews

InterviewsPension funds on the record: Private debt is not all it’s cracked up to be

Investment in the asset class has grown exceptionally in recent years among pension funds, but to some investors the risk-return profile is not attractive enough

-

Interviews

InterviewsPME Goes Back To The Future – PME Pensioenfonds

Marcel Andringa (pictured) of PME, the Dutch pension fund for the metal and electronics industry, talks to Tjibbe Hoekstra about the fund’s decision to ditch index investing and move to a more concentrated portfolio

-

Features

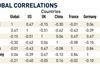

FeaturesResearch: How pension funds look at Chinese assets

Allocations to Chinese assets are still modest. Vincent Mortier and Amin Rajan discuss key issues in the third and final article from the latest Amundi-Create-Research Survey

-

Opinion Pieces

Opinion PiecesGuest viewpoint: The elephant in ISSB's drawing room

In mid-summer 2022, the International Sustainability Standards Board (ISSB) invited public comments on exposure drafts of its first two white papers: IFRS S1 on general requirements for disclosure of sustainability-related financial information, and IFRS S2 on climate-related disclosures. It received what was described as a “torrent” of responses.

-

Book Review

Book ReviewBooks: Financial crises and the failure of risk measures

This is a great book for anybody who would like to understand the causes and dynamics of financial crises. The author delivers deep insights into systemic financial risks for our economies, and why risk management tools and regulations fail when it matters most. The text is written in conversational style, full of anecdotes, wisdoms and polemics, which makes reading a pleasure even for the non-expert. To be recommended not only for risk managers but also for investment directors and trustees.

-

Features

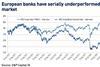

FeaturesFear and loathing in European banks

Any CEO would recognise there is a problem when investors do not want to put their money to work with you. That is the situation that European banks find themselves in. The MSCI Europe bank index has considerably underperformed its MSCI Europe parent over the last 10 years.

-

Features

FeaturesPrivate equity fundamentals resilient in headwinds

The economy and markets are beset with headwinds, and private equity assets are unlikely to be impervious. The concerns with the asset class are wide-ranging, from difficult financing conditions to rising interest rates, squeezed corporate margins and closed exit routes.

-

Interviews

InterviewsBain Capital: Vintage private equity

“In our world, it is quite easy to describe what we do, but it is very hard to do it,” says Robin Marshall, partner at Bain Capital. That statement encapsulates the concept of private equity and is also an effective introduction to his firm. Private equity may be a straightforward idea, but in reality it is an incredibly complex undertaking, which is why the asset class remains a non-core allocation within institutional portfolios.

-

Features

FeaturesFrom soft landing to no landing

Once again, the US jobs market has shown its capacity to surprise forecasters, if not astonish them. January’s non-farm payroll numbers came in way above consensus forecasts, swiftly reversing markets’ dovish take on that week’s central bank actions, with bond markets handing back much of their earlier gains.

-

Features

FeaturesAhead of the curve: The missing elements in the digital currencies debate

The recent contraction of the cryptocurrency markets poses questions about the viability of digital currency as an asset class for institutional investors. However, these developments have not undermined the efforts of central banks to pursue their own digital currency initiatives.

-

Features

FeaturesQontigo Riskwatch – March 2023

*Data as of 31 January 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator March 2023

The next Ukrainian offensive will be in April at the earliest, as modern tanks will have arrived by then. US Republican pushback of ESG and climate-related investments are a new bone of contention in relations with the EU, already strained by the Trump presidency, and a bad sign for US-EU co-operation on China policy, an issue Japan seems to be ducking successfully. Aided by a soft winter, EU energy concerns have become quite manageable.

-

Country Report

Country ReportCountry Report – Ireland (February 2023)

Ireland is preparing an Auto Enrolment Bill, which will kick-start the process of defined contribution pension reform in earnest, some 15 years after the concept was first mooted. The plan is for a Central Processing Authority to administer the system and for up to four providers to tender for a chance to manage member contributions.

-

Asset Class Reports

Asset Class ReportsEquities – Thematic funds tap into future trends

Themes have long captured the imagination of retail investors. Now institutions are showing interest, despite the lack of clear definitions

-

Special Report

Special ReportUK pension risk transfer market set for bumper 2023

Improved pricing and funding levels turned 2022 into a busy year for insurers, with more demand expected in 2023. But can they cope with the higher demand and will pricing remain competitive?

-

Country Report

Country ReportIreland: Viewpoint – Trustees, understand the employer covenant

Pensions may lose out if boards do not have a full grasp of the risks facing schemes

-

Country Report

Country ReportIreland: Final countdown to implementation for auto enrolment

Fifteen years after auto-enrolment was first mooted for Ireland, the automatic savings programme is nearly ready to be rolled out

-

Country Report

Country ReportIreland: IAPF view – The pension landscape is evolving fast

Reform of the Irish pensions system is in motion but much more needs to be done

-

Country Report

Country ReportIreland: Interview – Pensions Authority keeps an eye on LDI practices

Pensions Authority CEO Brendan Kennedy is not overly concerned about DB schemes’ LDI position, but feels the regulator needs more information. He speaks to Gail Moss about this and other issues facing the Irish industry