Latest from IPE Magazine – Page 54

-

Opinion Pieces

Opinion PiecesEuropean authorities must focus on derivatives risk

Opinions may differ on whether Brexit has had a positive or negative impact on either of the parties involved. However, it could be argued that an idiosyncratic event such as the liquidity crisis that took place in the United Kingdom at the end of September could have been averted, had the country been part of the bloc. Investors lost confidence in the UK government, now more isolated than before Brexit, and its ability to maintain its fiscal balance, after the announcement of a massive fiscal spending plan at the end of September. That sent yields on UK Gilts soaring and led to a spiralling lack of liquidity, as pension funds rushed to post collateral on their interest-rate derivative positions.

-

Opinion Pieces

Opinion PiecesGermany’s equity pension plan raises questions

The current legislative period could bring substantial changes to Germany’s pension system. The government is pursuing reforms to fund first-pillar pensions through a buffer fund invested in equities, although there is little consensus on its feasibility.

-

Features

FeaturesClimate risks – pay now or later?

Climate change is an emergency that requires all hands on deck. What should be the role of investors when it is governments that have the most power to effect change?

-

Features

FeaturesAccounting: Long-haul climate change reporting

Shortly after the International Sustainability Standards Board (ISSB) tentatively confirmed that companies using its climate-reporting standard must disclose their Scope 3 greenhouse gas (GHG) emissions, board chair Emmanuel Faber took to Twitter, making the bold claim that the board was “rewriting economics”.

-

Interviews

InterviewsDutch medical specialists: focus on healthy pensions

Marcel Roberts (right), CIO, and Ravien Sewtahal, investment manager of SPMS, the Dutch pension fund for medical specialists, talk to Carlo Svaluto Moreolo about risk management and sustainability

-

Features

FeaturesEuropean Commission announcement brings some clarity to derivatives clearing

Many unanswered questions linger after the departure of the United Kingdom from the European Union. However, a recent announcement by the European Commission (EC) promises to bring some much-needed clarity to the derivatives market.

-

Features

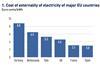

FeaturesESG: Germany’s energy options

The country’s reliance on Russian gas means its change of energy sources will carry a larger environmental cost

-

Interviews

InterviewsNewton’s Euan Munro: Seeking the best of both worlds

Euan Munro has built a formidable reputation in asset management, developing a major multi-asset absolute return strategy at Standard Life Asset Management in the 2000s. But the fortunes of his once mighty Global Absolute Return Strategy (GARS), now managed by Abrdn, have wavered as multi-asset strategies have fallen out of favour.

-

Interviews

InterviewsPension funds on the record: inspiring confidence in inflationary times

Rising inflation affects portfolio as much as morale, which is why many pension schemes are making extra efforts to advise their members

-

Opinion Pieces

Opinion PiecesUS: Republican House will not divert from SECURE 2.0

The new Republican majority in the US House of Representatives is not large enough to have a significant impact on the retirement industry.

-

Opinion Pieces

Opinion PiecesCOP15: Biodiversity develops investment ecosystem

Biodiversity is fast catching up with climate change as a priority for investors and supervisors, and developments last year have set the stage for a productive 2023.

-

Features

FeaturesPension funds at risk from cyber security threats

Regulators are increasingly focusing on the vulnerabilities of pension funds to the threat of cyber attack, which can bring disruption and potentially large-scale reputational fallout for schemes and sponsors

-

Features

FeaturesResearch: Pension investing in an inflation fuelled world

Monica Defend and Amin Rajan highlight the big upheavals facing pension investors

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Why and how we need to change the conversation about pension reform

In their new book, Power and Prediction, on the disruptive economics of artificial intelligence (AI), authors Ajay Agrawal, Joshua Gans and Avi Goldfarb write about the ‘between times’ between an important new discovery and the time it takes for that discovery to go mainstream. In 1879, Thomas Edison demonstrated the potential of the electric light bulb to change the world, yet 20 years later only 3% of US households had electricity. It would take another 20 years for that number to reach 50% of the population. For electricity the ‘between times’ were 40 years. This prompted the authors to wonder how long the ‘between times’ will be for AI.

-

Features

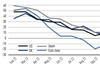

FeaturesFixed income, rates & currency: Inflation strengthens its grip

Whereas news of the hostilities in Ukraine may be losing their potential to shock and dislocate the world economic order, inflation news has maintained its powerful hold over financial markets across the world throughout 2022, with many economies recording their highest inflation levels for decades.

-

Features

FeaturesAhead of the curve: Is small cap the next mean reversion trade?

By now, most investors have noticed a rebound in value relative to growth in equity markets. After underperforming growth over the past decade, value stocks are experiencing strong mean reversion and outperforming significantly.

-

Features

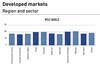

FeaturesIPE Quest Expectations Indicator - January 2023

Better air defence and the ground freezing over are steadily improving the outlook for Ukraine’s forces, now locked in stalemate. A series of blunders haunts US Republicans in general and Trump in particular. If Biden’s stimulus package is enacted, it will counteract Fed policy, possibly prolonging the series of interest rate increases. The EU seems to have bought too much gas. It has agreed to take border measures against some products from climate change laggard countries.

-

-

Features

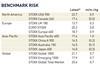

FeaturesQontigo Riskwatch - January 2023

*Data as of 30 November 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Special Report

Special ReportSpecial Report – Prospects 2023

The past year will be remembered as one of the most challenging for institutional investors ever. The outlook for 2023 is brighter, if anything because valuations of major asset classes have come back to historical levels.