Latest from IPE Magazine – Page 55

-

Asset Class Reports

Asset Class ReportsAsset class report – Equities

Factor investment strategies were once the ‘new black’ - scientific, quant driven approaches that could deliver the ‘smart beta’ nirvana of lower volatility returns and optimised exposure to robust return premia from small cap, value and quality stocks. Pundits always warned adopters that not all factors would perform all of the time - and indeed they didn’t. But investors are taking a fresh look at factor strategies now the extended spell of outperformance of growth stocks has passed, and value has reasserted itself.

-

Country Report

Country ReportCountry Report – Pensions in the Nordic Region (December 2022)

Nordic pension funds are getting to grips with biodiversity and natural capital in their investment portfolios, seeking to measure both the impact of companies they invest in and ways they can limit adverse effects on nature. Like other investors globally, many are just at the early stages of thinking about this - how they measure biodiversity, which metrics and approaches are gaining acceptance, and how best to report to stakeholders.

-

Special Report

Special ReportProspects 2023: Asset management roundtable

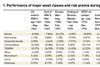

The past year was one of the most challenging ever for institutional investors. Here, asset allocators and others assess the current and future risks to portfolios and identify the opportunities in an environment that remains highly uncertain

-

Country Report

Country ReportNordic region: Investors embrace biodiversity initiatives

Measuring impact remains the biggest challenge

-

Asset Class Reports

Asset Class ReportsEquities – Factor investment strategies return to favour

After a few years of poor returns from factor investing, investors are again showing interest – but with more realistic expectations

-

Special Report

Special ReportProspects 2023: The inflation conundrum facing investors

Institutional investors would do well to include commodities and trend strategies to mitigate inflationary pressures

-

Country Report

Country ReportNordic region: Ilmarinen's roadmap for biodiversity change

Ilmarinen believes biodiversity and nature loss must be treated in the same way as climate change in investment activities

-

Asset Class Reports

Asset Class ReportsEquities – Is tracking error key to carbon reduction?

Passive investors may have to rethink their tracking error limits in the net-zero environment

-

Country Report

Country ReportNordic region: Danish pension funds on track to fund climate commitments

Denmark’s pension industry is calling for greater clarity from government on the timing of green projects and on the roles of different stakeholders

-

Asset Class Reports

Asset Class ReportsEquities – Investing in the midst of Europe’s gloom

Healthcare and luxury brands are two sectors with potential to stand out in an otherwise gloomy macro environment

-

Special Report

Special ReportProspects 2023: How important are the carbon markets?

Carbon pricing is key to investment in green technology

-

Special Report

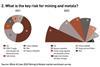

Special ReportProspects 2023: ESG-driven divestments threaten energy transition

Investor support for miners is crucial to ensure a sufficient supply of metals for renewable technology

-

Country Report

Country ReportNordic region: Key features of Iceland's pension success story

The country’s high participation rate partly explains why the pension system is highly rated worldwide

-

Special Report

Special ReportProspects 2023: Does zero China make sense?

Many investors are avoiding the People’s Republic, but they would do well to look at the reality

-

Country Report

Country ReportNordic region: Norway's wealth fund reassesses investment strategy

Review recommends great flexibility for its investment managers

-

Country Report

Country ReportNordic region: Interview with Richard Gröttheim, AP's outgoing CEO

Richard Gröttheim, AP7’s outgoing CEO tells Pirkko Juntunen about a pension system that many countries are keen to learn from

-

Opinion Pieces

Opinion PiecesTime to rethink defined contribution pensions design

This year is shaping up to be the worst for investment returns since before the great financial crisis, according to IPE’s latest performance analysis of the leading European pension funds.

-

Opinion Pieces

Opinion PiecesCOP27: more questions than answers but reasons to hope

Despite the cynicism around COP27 last month, there were some potentially major developments for investors. Excitingly, a number of them address what’s often ignored in climate finance discussions: moving money.

-

Opinion Pieces

Opinion PiecesDutch pensions reform: A never ending story

In the last two years, nearly all my contributions for this section have been about the ongoing reform of the Dutch pension system, which will involve the transfer of defined-benefit (DB) accruals to a defined-contribution (DC) setting.

-

Features

FeaturesHow SFDR became the impact benchmark star

Impact is often defined by intentionality and additionality.