Latest from IPE Magazine – Page 62

-

Special Report

Legal and regulatory developments: EU plays catch-up

While the European framework for establishing ETFs has not changed substantially in recent times, developments within the legislative bodies of the EU present a number of current and potential hurdles for ETFs in the short to medium term. This article will look at each legal development in turn. It is also important to note that the COVID-19 pandemic has highlighted a number of areas that need to be strengthened.

-

Special Report

Special ReportIPE ETF Investor Survey 2022

IPE’s first survey of investors focusing specifically on ETFs, conducted between mid-July and mid-August 2022, drew responses from institutional investors across nine European jurisdictions, of which 24% were invested in ETFs. Respondents were located in Belgium, Denmark, Germany, Italy the Netherlands, Portugal, Spain, Sweden and the UK.

-

Asset Class Reports

Asset Class ReportsEquities – Are Paris-aligned benchmarks a climate gamechanger?

Inflexible annual carbon reduction targets and weak data can lead to flawed decision-making

-

Special Report

Special ReportTop 1000 Pension Funds 2022: Pension assets increase reflects 2021’s markets

The assets of the leading 1000 European pension funds increased by well over €600bn in our latest survey – a large portion of which can be attributed to strong investment returns on the back of a sustained post-COVID rebound over the course of 2021.

-

Asset Class Reports

Asset Class ReportsEquities – Fundamental managers on the search for quality and growth

At a time of high volatility in markets, bottom-up selection based on equity fundamentals is as relevant as ever, but managers remain challenged to find resilient companies

-

Special Report

Top 1000 Pension Funds 2022: Data

OECD Pension Funds in Figures, 2022 (data for France from 2021 edition); *Data on asset allocation in these figures include both direct investment in equities, bills and bonds, cash and deposits and indirect investment through CIS when the look-through of CIS investments is ...

-

Country Report

Country ReportNetherlands: Pension transition drives consolidation

Pension schemes are turning to mergers as one way to cope with the rising costs of complying with greater regulation

-

Country Report

Country ReportNetherlands: Dutch pension funds make early switch to DC

There are various HR and corporate motives for switching to defined contribution arrangements before the new pension system comes into play in the Netherlands

-

Special Report

Austria: Debate on pension reforms continues

Promises to review Austria’s pension system made over recent years have not materialised, resulting in a renewed push for action by the pension industry

-

Country Report

Country ReportNetherlands: Implications of the new pension system

The move towards a new Dutch pension system will have significant effects on swap curves and asset allocation

-

Special Report

Belgium: Limited agreement on pension changes reached

A minimum monthly first-pillar pension will apply from 2024 but there has been little effort to boost supplementary schemes

-

Special Report

Denmark: Commission heralds comprehensive approach

Expert body tackles complexity, incentives, tax and indexation

-

Special Report

Finland: New laws passed ahead of unified pensions blueprint

Working group proposals for merging pension systems yet to be published

-

Special Report

France: New government revives pension reform

Under Emmanuel Macron’s second presidential term, the French government hopes to achieve an overhaul of the first-pillar pension system

-

Special Report

Special ReportGermany: Unlocking innovation and improving risk assessment

The German government is encouraging institutional investors to invest in venture capital funds to help support start-up companies

-

Opinion Pieces

Opinion PiecesInstitutional capital for energy resilience

Ukraine’s independence day on 24 August also marked six months since the start of Russia’s invasion and with it a profound shift in the global geopolitical and economic balance.

-

Opinion Pieces

Opinion PiecesHeatwaves remind us climate finance is more than net zero

In the middle of the now-famous speech that ended Stuart Kirk’s tenure as HSBC’s head of responsible investment, he said something that got lost. While most of Kirk’s controversial May presentation on ‘why investors need not worry about climate risk’ was picked apart on social media and in the press – resulting in his suspension and exit from the asset manager – his slide on climate adaptation (or ‘adaption’) was largely ignored.

-

Opinion Pieces

Opinion PiecesNotes from Amsterdam: Reform speeds up consolidation

With each passing day the likelihood diminishes that the law on the future of pensions (Wet toekomst pensioenen) will come into force as planned on 1 January next year. The law was sent to parliament in spring this year, but a date for parliamentary discussion is yet to be set.

-

Opinion Pieces

Opinion PiecesPrivate managers ‘not serious’ about climate

Fears about the effect of human activity from the climate date from the ancient Greeks, but it was not until the 1980s that scientists began to unite for action on climate change, and the warnings have only escalated since. Too often they have been ignored or denied.

-

Features

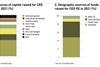

FeaturesCEE private equity: in search of capital

War in Ukraine is just one factor deterring investment in private equity and growth capital in Central and Eastern Europe