Latest from IPE Magazine – Page 63

-

Features

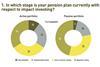

FeaturesResearch: The democratising of impact investing

Amin Rajan and Sebastian Schiele find investors are opting for more social-related investing

-

Interviews

InterviewsOn the record: bracing for uncertain times

Investors stay true to their diversification strategies in response to an increasingly complex inflation and global growth outlook. Alternatives are still seen as the best instrument to diversify risk

-

Special Report

Special ReportIceland: International Monetary Fund warns on system risk

Despite its top-ranking pension system, there has been slow progress on increasing diversification abroad and in infrastructure

-

Interviews

InterviewsRailpen: Next stop, sustainable long-term returns

Richard Williams (pictured), CIO of Railpen, the manager of the UK’s rail transport pension schemes, talks to Carlo Svaluto Moreolo about the institution’s investment strategy, governance model and commitment to sustainability

-

Opinion Pieces

Opinion PiecesAustralia: Downturn casts a shadow over super anniversary

Australia’s superannuation industry enters its fourth decade under the darkening clouds of a global economic slowdown that is already having a dramatic impact on returns.

-

Opinion Pieces

Opinion PiecesUS: The great unfreeze - does it make sense to reopen DB plans?

US defined benefit (DB) public and corporate pension funds are responding differently to inflationary pressures. Public schemes are more concerned about the negative impact of financial market turmoil on their returns, while corporates are enjoying the rising discount rates that are lowering their liabilities and improving their funded status.

-

Opinion Pieces

Opinion PiecesESG Viewpoint: Article 9 of SFDR – the new green lodestar?

Regrettably, the EU’s Taxonomy for Sustainable Activities has gone from proposing “real change” to “may be imperfect”. These are the polite words of EU financial services commissioner Mairead McGuinness. Less politely, Greta Thunberg judged that the taxonomy simply “takes greenwashing to a completely new level [since t]he people in power do not even pretend to care any more. They just label fossil gas as green and nuclear waste as pollution controllable over the next 100,000 years.”

-

Interviews

InterviewsStrategically speaking interview: Italian, global and poised for growth

In asset management, three years can be a short or a long time, depending on many factors, including market conditions. To some asset management executives, the second half of the 2010s perhaps felt like an endless slog, due to the intense competition for market share and outperformance within the seemingly never-ending bull market. The first two years of the new decade have certainly elapsed more quickly, thanks to the historical significance of the events that have occurred.

-

Features

FeaturesWe need better climate models to manage global warming impacts

Travelling back to the UK from Sri Lanka in July, I experienced a 10-degree temperature rise with the UK hitting over 40°C. While some people may argue that such extreme temperatures in the UK could just be a statistical anomaly, climate scientists such as Tim Palmer, Royal Society research professor in climate physics at Oxford University, who I spoke to at length on the subject, have no doubt that global mean temperatures are rising as a result of greenhouse gas emissions caused by human activities.

-

Features

FeaturesAccounting: Packed agenda as ISSB takes shape

ISSB board aims to finalise its first two sustainability standards by the end of the year A consultation on the ISSB’s work priorities is planned for later this year The role of materiality in sustainability reporting remains a hotly debated topic

-

Opinion Pieces

Opinion PiecesGuest viewpoint: Pension funds and the EU’s sustainability agenda

The European Commission’s Sustainable Finance Strategy, published in summer 2021, sets out how it will support the EU Green Deal and Europe’s transition to carbon neutrality by 2050.

-

Features

FeaturesEuro peripheral spreads

Just over a decade ago, Mario Draghi, then President of the ECB, gave a speech in which he uttered the famous words: “.…the European Central Bank [ECB] is ready to do whatever it takes to preserve the euro”, a phrase often credited with hauling Europe out of the depths of its sovereign debt crisis.

-

Features

FeaturesCommodities show their value

The few pension schemes with an investment in commodities benefitted from this allocation in recent months. Prices in this asset class rose as the pandemic and war in Ukraine pushed up the cost of fossil fuels and re-ignited inflation while both equity and bond markets faltered.

-

Features

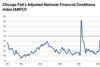

FeaturesFixed income, rates & currency: defying historical norms

Another US jobs report comes in significantly above consensus. Its across-the-board strength, upward revisions to previous reports, and an unemployment rate at the lowest level since 1963, may indicate that the economy is not quite as near recession as previously surmised. And with inflation still rising, albeit slightly less fast than expected, the outlook remains cloudy.

-

Features

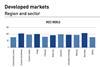

FeaturesAhead of the curve: Are defensive strategies delivering?

Introducing ‘defensiveness’ to equity portfolios can take many forms. At the most explicit end of the spectrum, we can consider dialling down market exposure using derivative-based equity overlays – whether these are static protection programmes or more complex dynamically managed strategies which could even include some implicit volatility trading. At the more implicit end, promising reduced ‘downside capture’, we find a wide array of defensive long-only equity strategies.

-

Features

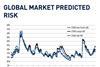

FeaturesQontigo Riskwatch - September 2022

*Data as of 29 July 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

IPE Quest Expectations Indicator - September 2022

The war in Ukraine is characterised by a build-up for the battle for Kherson. The result of that campaign is likely to have great political influence on both sides. Neither is capable of a surprise win, but time works against Russia. In the US, Trump’s legal troubles are serious and mounting, but any Republican successor may be even more destructive. The EU is running against time to prepare for winter. Both optimists and pessimists are over-estimating the ability of technicians to predict the future. Russia has lost the EU as a primary customer for its oil and gas. It must make up for higher distribution costs by offering significant discounts.

-

Special Report

Ireland: IORP implementation prompts consolidation

Ireland’s pensions trade body warns that many smaller schemes will be unable to meet the requirements of IORP II, accelerating the move to master trusts

-

Special Report

Italy: Debate on reform continues ahead of snap election

Plans announced to lower the retirement age and raise public benefits, but there has been little discussion of a greater role for second-pillar pensions