Latest from IPE Magazine – Page 65

-

Opinion Pieces

Opinion PiecesHow to bridge a most obvious pension investment gap?

Investment luminaries were recently invited by the CFA Institute to give their opinion on the financial system in a publication to mark the quarter century of the institute’s research award to commemorate Jim Vertin.

-

Interviews

InterviewsItaly's Previndai pension fund: On a journey to diversification

Alessandro Ciucci, CFO at Previndai, one of Italy’s largest pension funds, talks to Luigi Serenelli about its diversification strategy built on alternatives

-

Opinion Pieces

Opinion PiecesNorway needs another pensions overhaul

It’s official – Norway’s state pension system needs another overhaul. The Pension Commission published its hefty report in June arguing for changes to make it socially sustainable – raising age limits, pegging minimum benefits to wage growth and shielding disability pensions from the effects of life expectancy adjustment.

-

Interviews

InterviewsStrategically speaking interview: Jose Minaya, Nuveen

Asset managers with a yield-hungry pension investor as a parent nowadays usually have to diversify their footprint into private markets, often by acquisitions in one form or another.

-

Features

FeaturesA flawed EU crypto regulatory framework

The EU will soon have a specific regulatory framework for crypto currencies and markets. Under proposals soon to be adopted, only crypto coins authorised in the EU will be allowed to be offered to investors. But crypto assets and exchanges will have a very light supervisory regime, much less than what is in place for financial instruments and exchanges. This raises the question about the rationale for distinct rules. This question is even more acute in the context of the big decline in the crypto markets over the past weeks.

-

Opinion Pieces

Opinion PiecesUS: A cautious approach on private assets in DC plans

Will 2022 be the year when private equity is finally incorporated in US defined contribution (DC) plan line-ups? Possibly, following the Department of Labor’s (DoL’s) clarification of its position in a letter last December. But it will be a very slow process, according to industry experts.

-

Features

FeaturesChina calls the tune for emerging markets

If President Xi Jinping mismanages China, the careers of many emerging market asset managers could be over. It would also mean emerging markets as an asset class would become irrelevant, at least according to Xavier Hovasse, head of emerging markets at the French fund management house Carmignac, who has devoted his career to seeking opportunities in emerging markets.

-

Features

FeaturesA broader view on corporate pension disclosures

What is not to like? Finally, a principles-based approach to the disclosures in financial statements that aims to cut the clutter and home in on the material that is truly material.

-

Features

Features‘Painful’ private equity fees are hard to avoid

The Netherlands’ €551bn ($576bn) civil service scheme ABP paid a record €2.8bn in performance fees to private equity managers in 2021, prompting the fund’s president Harmen van Wijnen to announce an external investigation to assess ABP’s rising asset management costs. The €277.5bn healthcare scheme PFZW paid €1.26bn in performance fees to private equity last year, accounting for two thirds of total asset management costs.

-

Features

FeaturesAsset owners need to find the best stock pickers

For pension funds, an asset manager search is a high-stakes exercise. Get it wrong and the scheme could be saddled with an underperforming manager for an extended period of time, dragging down returns and potentially impacting member outcomes.

-

Features

FeaturesCustodians will be key as investors move into digital assets

Digital assets may seem to be the latest investment trend, but institutions are taking their time in embracing them. Moving interest to the next level will require not only greater regulation but also a solid network of custodians to provide the required security and protection.

-

Features

FeaturesFixed income, rates & currency: inflation battle in full swing

As we reach the midpoint of the year, there is little sign that the second half of 2022 will be any less turbulent than the first. The conflict in Ukraine slogs on – a destructive war of attrition, pain and fear. The repercussions are huge, global and unpredictable, be they surging energy prices or impending, but acute, shortages of basic foodstuffs, or of semi-conductors, so vital to 21st century life.

-

Features

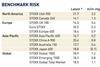

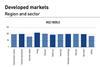

FeaturesQontigo Riskwatch - July/August 2022

* Data as of 31 May 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

-

Features

FeaturesIPE-Quest Expectations Indicator commentary August 2022

The war in Ukraine has reached stalemate. Neither party is capable of a surprise win, but time works against Russia. Can Zelensky keep the army motivated to continue? A long, hot European summer

-

Opinion Pieces

Opinion PiecesAustralia: Superannuation funds on a consolidation path

Australians are beginning to get used to super funds with names like Australian Retirement Trust, Aware Super and Spirit Super.

-

Special Report

Special ReportSpecial Report – Outlook

It’s hardly news that inflation is high on asset owners’ minds right now. We asked eight seasoned asset allocators, CIOs and strategists the same question: how do you rate the chances of stagflation? And what to do about it?

-

Country Report

Country ReportCountry Report – Pensions in the Nordic Region (June 2022)

We open our June Nordic Region report with a stark question: are asset managers living up to asset-owners expectations on ESG, in particular when it comes to climate change reporting?

-

Special Report

Special ReportTop 500 Asset Managers 2022

The emergence of persistent higher inflation, China’s zero-COVID policy, stress on global supply chains, and Russia’s Ukraine war all suggest that the asset total of this year’s IPE Top 500 Asset Managers Guide represents a high water mark.