Latest from IPE Magazine – Page 66

-

Country Report

Country ReportNordic Region: Pension funds look to asset managers for climate action

Asset managers have been criticised for slow actioning of investors’ ESG policies

-

Special Report

Special ReportOutlook: The search for safe havens

Are we heading for stagflation and how should institutional investors prepare?

-

Special Report

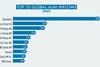

Special ReportTop 120 European Institutional Managers 2022

Total non-group assets managed for all types of European institutional clients – pension funds, insurance companies, corporates, charities and foundations – for the leading 120 managers in this business segment. Total assets are €14.4trn (2021: €12.2trn)

-

Special Report

Special ReportOutlook: Investors grapple with inflation and rising rates

The asset allocation options available to institutional investors in such uncertain times are few

-

Country Report

Country ReportNordic Region: Sweden prepares for a pensions reboot

The Swedish Fund Selection Agency is set to take over the reins of the SEK 2trn premium pension system following a series of scandals

-

Special Report

Outlook: Can investors act alone on energy policy?

It may be up to governments to set the rules of engagement to achieve net zero

-

Country Report

Country ReportNordic Region: KLP fosters healthy start-up culture

The Norwegian pension fund’s accelerator programme teams up with CoFounder to help early-stage businesses with investment, advice and management

-

-

Country Report

Country ReportNordic Region: Dorrit Vanglo exit interview

For LD’s outgoing CEO, being mindful of working with other people’s money is key – as is a sense of humour

-

Special Report

Special ReportOutlook: Future of hydrocarbons

The OECD remains critically dependent on Russian oil and gas – and finding alternative sources will be very hard

-

-

Special Report

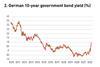

Special ReportOutlook: Good riddance to negative interest rates

The net effect of setting interest rates below zero is negative, and central banks may be wary of such policies in the future

-

Special Report

Special ReportFour challenges for asset managers

Leading figures respond to key questions on ● Investment strategy ● ESG

-

Opinion Pieces

Opinion PiecesPension funds and asset managers: Are you a Yamaha or a Steinway?

In the 1970s, Genichi Kawakami, president of Yamaha Corporation from 1950-77, wanted his pianos to rival those of Steinway.

-

Opinion Pieces

Opinion PiecesInvestors should require companies to tie executive pay to ESG targets

Stuart Kirk, global head of responsible investing at HSBC Asset Management, has been suspended for saying that investors need not worry about climate risk. Those among the company’s clients who are concerned with sustainability may be relieved that he has been suspended, but there remain questions about greenwashing at the company and within the whole asset management sector.

-

Opinion Pieces

Opinion PiecesDelay looms to Netherlands reform process

The Dutch government has vowed to finalise the country’s hotly debated switch to a pension system with defined-contribution variants by 1 January 2023.

-

Opinion Pieces

Opinion PiecesIlliquid assets could bring cost burden

Last month the UK’s Department for Work and Pensions (DWP) closed its consultation on ‘Facilitating investment in illiquid assets’, which sought views on policy proposals and draft regulations designed to improve the accessibility of illiquid assets for defined contribution (DC) pension schemes.

-

Features

FeaturesAccounting: IASB risks project duplication over sustainability

Looking back, the warning signs were clear. “The trustees of the IFRS Foundation are considering whether [we] should play a role in the development of sustainability reporting standards,” the March 2021 exposure draft explains.

-

Features

FeaturesResearch: beyond the net-zero hype

The exact path to a net zero world is unknown but the direction of travel is clear, argues Amin Rajan