Latest from IPE Magazine – Page 73

-

Asset Class Reports

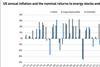

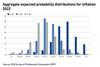

Asset Class ReportsPortfolio Strategy – Inflation: A new regime

CIOs and asset allocators discuss the effect of inflation on portfolios

-

Features

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

Features

FeaturesAhead of the curve – Late-stage growth: a growing priority in PE portfolios

With additional options to fund growth outside of an initial public offering (IPO), start-ups are staying private longer. The average age at which venture capital-backed companies go public has increased from about 4.5 years during the 1990s to about 6.5 years today.

-

Features

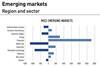

FeaturesQontigo Riskwatch – March 2022

* Data as of 31 January 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

FeaturesIPE Quest Expectations Indicator – March 2022

Political risk is back. Russian aggression towards Ukraine inserts considerable amounts of uncertainty. Asset owners will in general not suffer significant direct consequences for a well-diversified portfolio, but there are potential implications for energy prices that come at a time when inflation was already making a comeback and on top of unexpected military expenditure when budgets are already charged by COVID-19-related outlays

-

-

Features

Case study – SPH: How to embed behavioural insights in managing a pension fund

In the Netherlands, pension reforms are slowly picking up steam. Long overdue and in many respects a sensible direction, pension boards can choose between variants that redistribute investment risk between individual participants and the collective pension scheme.

-

Special Report

Special ReportPensions regulation in the UK

Developments in the pensions landscape in the United Kingdom

-

Country Report

Country ReportCountry Report – Pensions in Ireland (February 2022)

Ireland’s new trustee code is bedding in following its publication last autumn. The code aligns Ireland with IORP II, with rules on governance, administration, controls, DB management and ‘fit and proper’ requirements.

-

Special Report

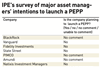

Special ReportSpecial Report – Pan-European Personal Pensions

From March, the European Commission’s vision of a simple, cross-border savings product becomes a reality with the launch of the Pan-European Personal Pension Product (PEPP). EU citizens will for the first time be able to channel savings into a long-term third-pillar product that is cost effective, simple and portable across borders.

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Hedge funds: macro bets on

Global macro funds should do better in the current market environment – but not all will thrive and investor due diligence will be key

-

Country Report

Country ReportRevised code of practice beds in

Ireland’s Pensions Authority published its revised code of practice for occupational pension scheme trustees last November, to a lukewarm reception. After a lukewarm response, trustees are getting to grips with what is required of them

-

Special Report

Special ReportPEPP: Few players on the starting line

In March, the European Union’s Pan-European Personal Pension Product (PEPP) framework comes into effect, amid doubts about the take-up by providers

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy - Hedge Funds: Juggling the ESG imperative

ESG has the power to transform, but do hedge funds have the drive, data and determination to fit sustainability into their investment process?

-

Country Report

Country ReportFunding levels down, but outlook good

An update on the accounting deficits in Irish DB pension schemes

-

Special Report

Special ReportThe jury is still out on PEPP: industry views

IPE asked some of the leading voices in the European pension industry to comment on the likelihood of success for the PEPP

-

Country Report

Country ReportChallenges await after a year of policy change

Reform of the Irish pensions system is in motion with policies set out last year

-

Special Report

Special ReportFrancesco Briganti: All’s well that ends well for PEPP?

Despite the remaining questions, the impact of the PEPP on European pensions could be positive

-

Country Report

Country ReportAuto-enrolment: a never-ending story?

COVID, Brexit and elections all contributed to the delay in the introduction of the workplace schemes