Latest from IPE Magazine – Page 75

-

-

Features

FeaturesIPE Quest Expectations Indicator - February 2022

Wait and see

Omicron surprised a world that thought COVID was almost over. Infections shot up in the EU, UK and US, reaching all-time highs, especially in France. However, while absolute levels remain high, the curves have turned and panic is abating. Death rates were little affected. -

Country Report

Country ReportCountry Report – Pensions in Central & Eastern Europe (January 2022)

A combination of poor policy decisions and conservative asset allocations have conspired to stifle the development of supplementary pensions in the CEE region since the widespread adoption of the World Bank’s three-pillar model in the 1990s, as IPE Editor Liam Kennedy writes in this issue.

-

Special Report

Special ReportSpecial Report – Sustainability & reporting

Increasing levels of ESG investing require greater transparency across the value chain, not least from companies. Enter the International Sustainability Accounting Standards Board, which will take shape this year and which is currently recruiting 11 inaugural board members.

-

Asset Class Reports

Asset Class ReportsPortfolio Strategy – Fixed income report

As the earnings season gets under way in early January, we look at 2021’s bumper level of bank debt issuance, in particular from Bank of America, JP Morgan and Citigroup, which have all recorded big increases in deposits. Banks look set to benefit from rising rates this year, but also from their historically large capital buffers, diverse funding levels and central bank liquidity backstops and offer attractive valuations.

-

Country Report

Country ReportM&A reshapes CEE pensions market

Some European insurance groups are retreating from the CEE region, while others are snapping up assets. All this is reshaping pillar-two pensions

-

Special Report

Special ReportISSB: A new body for sustainability standards

As it comes to life, the new International Sustainability Standards Board faces a complex path towards harmonisation of fragmented frameworks

-

Asset Class Reports

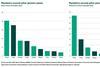

Asset Class ReportsUS banks lead a boom in debt issuance

Capital requirements and locking in cheap funding have prompted banks to issue more bonds, but Europe lags behind

-

Country Report

Country ReportPoland’s slow start on pensions

Poland’s automatic enrolment programme continues to suffer from an endemic lack of trust

-

Asset Class Reports

Asset Class ReportsThe green bond imperative

A deepening pool of green bond issuance is allowing investors to direct capital towards objectives like energy transition

-

Opinion Pieces

Opinion PiecesViewpoint: Transparency is set to transform ESG reporting

Three things to keep in mind as the International Sustainability Standards Board starts work on sustainability standards

-

Country Report

Country ReportInterview: Dace Ljusa

After 18 years as CEO of Latvia’s SEB Pension Fund, Dace Ljusa has just stepped down. She is now turning her sights to developing a strong corporate governance ethic throughout her home country and the Baltics

-

Asset Class Reports

Asset Class ReportsABS stages a comeback

‘Punitive’ regulations and onerous policies in the wake of the financial crisis saw the ABS market shrink dramatically. But complexity and an illiquidity premium offer opportunities for pension funds

-

-

Opinion Pieces

Opinion PiecesViewpoint: Eumedion welcomes a fruitful start on standards

IPE questioned Martijn Bos, policy adviser at the Dutch institutional investor corporate governance and sustainability forum Eumedion, about the new ISSB

-

Opinion Pieces

Opinion PiecesLacklustre pensions in an innovative CEE region

Capital funded pension systems across the Central and Eastern Europe (CEE) countries have suffered from poor policy decisions over the years. These have included suspensions or reductions to contributions and even transfers of assets from individual accounts to the state.

-

Opinion Pieces

Opinion PiecesNews Notes: PEPP cap elicits muted response

The date for authorisation for the so-called Pan-European personal pension product (PEPP) is fast approaching – 22 March 2022 – and yet the European pensions market seems to be relatively quiet about it.

-

Interviews

InterviewsExit Interview: Heribert Karch, former CEO of MetallRente

“I have been managing director at MetallRente since the beginning, exactly since 1 November 2001,” says Heribert Karch, weeks before leaving his post after 20 years at the helm of the German pension scheme. MetallRente has also just celebrated the twentieth anniversary of its foundation.

-

Interviews

InterviewsOn the record: Asset allocation

Three European pension funds discuss their outlook for 2021 and beyond, amid the uncertainty caused by inflation and a new strain of the coronavirus

-

Features

FeaturesStrategically speaking – AlbaCore Capital: Alternative credit with pension fund roots

AlbaCore Capital, a Europe-based alternative credit specialist with North American roots, is a fairly rare example of an asset management company that was spun off from a pension fund. David Allen, founder and CIO, established the company in 2016, with a team of European alternative credit specialists that he led from within the $542bn (€366bn) Canada Pension Plan Investment Board (CPPIB).