Latest from IPE Magazine – Page 77

-

Special Report

Special ReportSpecial Report – Prospects 2022 for European Institutional Investors

It’s all about inflation, stupid! Well, yes and no. While inflation is one of the top concerns raised by contributors to our vox-pop section on the economic outlook, growth and interest rates feature highly too. On the topic of inflation, EFG Bank’s Stefan Gerlach outlines why inventors should look at the underlying components of headline inflation numbers. We also look at the NextGenerationEU bond issuance programme, and the implications on the bond market. And energy specialist Cyril Widdershoven outlines the case for oil and gas as a transition play.

-

Asset Class Reports

Asset Class ReportsTech: Uncertain future as FAANG stocks mature

Innovative tech giants deliver many societal benefits, but concerns over personal data misuse and market power abuse could elicit regulatory responses that inadvertently stifle innovation

-

Country Report

Country ReportDenmark: Ambitious Denmark leads on green-energy transition

Pension funds play a key role in achieving carbon emissions target set for 2030

-

Special Report

Special ReportOutlook: New challenges await

Inflation rising above central bank targets in both the US and Europe threatens the global economy as it recovers from the shock of COVID-19. The impact on interest rates and growth is unclear, leaving investors with a dilemma on their hands. Should they continue to maintain a risk-on stance or raise their defences against potentially higher volatility throughout next year? At this time of uncertainty, IPE asked a selection of CIOs and strategists to comment about their asset allocation priorities for 2022 and beyond

-

Asset Class Reports

Asset Class ReportsThe end of social media as we know it?

Increased scrutiny of the power of Facebook, Twitter and Google to influence public opinion may force shareholders to make some uncomfortable decisions

-

Country Report

Country ReportIceland: Pressure to relax limit on foreign investing

Pension funds look for flexibility to adjust their exposure to global opportunities

-

Special Report

Special ReportThe importance of defining inflation

Investors must reflect on the nature and components of the current rise in inflation

-

Country Report

Country ReportIceland leads the world on pensions

Nation’s retirement system rates high in pensions index for adequacy and sustainability, allowing it to pip the Netherlands and Denmark

-

Special Report

Special ReportNextGenEU: Towards a new euro yield curve?

Bonds designed to support member states hit hardest by the pandemic look set to become a new safe asset

-

Country Report

Country ReportFinland: Declining birth rate is main worry

The country’s defined benefit pension system is largely healthy, but long-term challenges need to be addressed now

-

Special Report

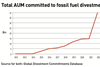

Special ReportEnergy: Are pension funds missing out in the rush to decarbonise?

As investors divest from fossil fuels, others are stepping in, and the result is not lower emissions from the hydrocarbon industry

-

Country Report

Country ReportInflation: Schemes keep wary eye on inflation

Few players anticipate rampant inflation rises, but pension funds are atuned to the actions of central banks around the world

-

Country Report

Country ReportFunds collaborate on green credit

Swedish funds team up with fund managers by providing seed money for two new sustainable bond products

-

Opinion Pieces

Opinion PiecesNo right side to the inflation debate

The question of whether the current trend of rising inflation is a transitory or permanent one is not trivial. It is forcing the institutional investor community to reflect on their long-term investment strategies. Investors have to review their current approaches and get ready to make significant changes if their views prove incorrect.

-

Opinion Pieces

News Notes: Economies of cost saving

The three main reasons the UK government requested that the country’s 89 Local Government Pension Schemes (LGPS) pool their assets back in 2015 were: establishing common investment vehicles to provide the pension funds with a mechanism to access economies of scale; helping them to invest more efficiently in listed and alternative assets; and reducing investment costs.

-

Features

FeaturesLong term matters: What COP26 means for you

Whether the COP26 glass is half full or half empty is the wrong question.

-

Interviews

InterviewsOn the record: Social issues

Three European pension funds discuss their increasing focus on social factors within their ESG-driven investment strategies

-

Opinion Pieces

Opinion PiecesGetting ahead of the skill curve

Twenty years ago, in December 2001, Denmark’s giant labour market pension fund ATP implemented an interest-rate swap. That doesn’t seem too shocking now as liability-driven investment (LDI) is a mature and well-understood concept that is embedded in pension risk-management and regulatory practice.

-

Interviews

InterviewsHow we run our money: Oslo Pensjonsforsikring

Lars Haram (pictured), CIO of Oslo Pensjonsforsikring, tells Pirkko Juntunen about the fund’s evolving risk-management strategy

-

Opinion Pieces

Opinion PiecesNotes from the Netherlands: Too eager to index

Most Dutch pensioners have been craving indexation ever since the financial crisis in 2008-09. Understandably, patience is running thin, especially now that inflation has reached its highest level since the introduction of the euro.