Latest from IPE Magazine – Page 85

-

Special Report

Special ReportMulti-purpose, measuring up and poised for the European mainstream

As the world economy emerges from COVID-19, the relentless rise of ETFs continues. Assets invested in ETFs and ETPs listed globally reached a record $9.35trn (€7.94trn) at the end of June 2021, with year-to-date net inflows at a record $660.7bn, according to research firm and consultancy ETFGI.

-

Special Report

Special ReportThe ETFs that could gain from the Biden presidency

US President Joe Biden has set out ambitious spending plans since taking office in January. Investors are looking closely at what this means for markets and monetary policy.

-

Special Report

Special ReportInvestor self-seeded ETFs: the dos and don’ts

Two of Finland’s biggest pension firms – Varma and Ilmarinen – have initiated the launch of several ESG-themed ETFs over the past few years. In April this year, Ilmarinen announced it was investing €170m in the new AXA WF US high yield low carbon bonds fund, which focuses particularly on the carbon and water intensity scores of issuers, acting as a seed investor for the fund launch.

-

Special Report

Special ReportFrom fixed weights to all-weather: rethinking the 60/30/10 portfolio

In the current environment of low interest rates, policy uncertainty, large dispersion of global growth outlooks and gyrating equity markets, asset allocation is one of the foremost considerations for investors. Fixed weight portfolios such as the 60/40 portfolio (ie, 60% equities and 40% fixed income) have been widely used – the main benefits being their conceptual simplicity, ease of implementation and, historically, the diversification benefits across equity and fixed income returns.

-

Special Report

Special ReportGreen ETFs: a perfect pairing or fleeting fad?

Sustainable investing is here to stay. What was once a set of niche strategies for environmentally conscious investors is now an industry expected to hold a third of global assets by 2025, according to Bloomberg analysis.

-

Special Report

Sustainable ETFs are a pension scheme’s friend

Pension fund trustees already face myriad challenges and, today, most schemes face a timeline for compliance with various climate and ESG regulations, which vary by country, scheme type and scheme size. Meanwhile, the intensifying spotlight being shone by scheme members on areas like climate, diversity and stewardship will continue to pave the direction of travel.

-

Special Report

Special ReportBuilding stronger portfolios for a low carbon world

Limiting further global warming will require less fossil fuel use and an increase in the production and use of greener forms of energy. As the world transitions to a low carbon economy, investors need to prepare their portfolios to manage the risks and capitalise on the opportunities that are being created across all markets, sectors and regions.

-

Special Report

Special ReportESG and fixed income: a new direction for ETF investors

Fixed income has long lagged equities in the environmental, social and governance (ESG) investing space, but we are at a turning point in ESG investing in corporate bonds, for both active and passive management. Rising demand for ESG debt is leading to the development of a rapidly expanding range of fixed income solutions. As increasingly socially conscious investors re-evaluate their asset allocations, fixed income exchange-traded funds (ETFs) present an opportunity for the reshaping of portfolios.

-

Special Report

Special ReportESG futures: building from a strong foundation

Environment, social and governance (ESG) criteria have moved to the forefront of fund managers’ decisions, meaning that risk, reward and sustainability are now the three key considerations when investing.

-

Special Report

Special ReportESG outperformance: not about one factor

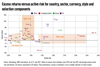

The recent outperformance of many ESG indices relative to broad market indices is well documented. The resilience of ESG strategies during the COVID-19 crisis has broadened the appreciation and appeal of ESG.

-

Special Report

Special ReportTurning scale and commitment into influence

The popularity of passive strategies such as ETFs among institutional investors might at first sight appear inconsistent with the role of asset owners as effective corporate stewards. The reality is that passive does not equate to a lack of interest or influence.

-

Special Report

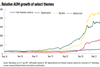

Special ReportIndex design: do your research

Thematic exchange-traded funds (ETFs) are not new but over the past year those with a sustainability and technology slant have captured the imagination. Inflows have surged but investors are advised to be vigilant and judiciously examine the index construction and approach. As past events have shown, it is too easy to be caught off guard by rebalancing or by stocks that may not fit the bill.

-

Special Report

Sustainable evolution puts index design centre stage

As the growth in sustainable investing continues to gather pace, index-based solutions have become popular with investors as a simple, low-cost and transparent way to implement sustainable strategies.

-

Special Report

Special ReportWhat the data-led technology revolution means for ETFs

Since launching in the early 1990s, ETFs have had a considerable impact on the investment landscape, providing a low-cost, simple alternative to mutual funds.

-

Special Report

Special ReportTheme regime: thematic investing and asset allocation

Portfolio construction has come a long way from the early work of Markowitz back in the 1950s. In the late 1990s and early 2000s, investors found more sophisticated quantitative methods to assess risk, expected return and the associated investment opportunities through mathematical machinery such as factor modelling.

-

Special Report

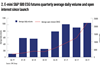

Special ReportBonds, boutiques and Bitcoin: ETF trends in 2021

The extreme events of 2020 sent ripples through the exchange-traded fund (ETF) market. Highly volatile markets in the first quarter gave way to a huge rally later in the year, with thematic products in particular reaping the benefits of significant inflows.

-

Special Report

Special ReportSemi-transparent ETFs: balance and confidence

For now, active semi-transparent or non-transparent exchange-traded funds are likely to remain unique to the North American and Australian investment markets; their European counterparts appear reluctant to take the plunge, although some industry experts believe this will change in time.

-

Special Report

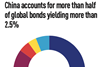

Special ReportChina bond ETFs: the path to a new opportunity

Historically, investors outside of China have struggled to access the country’s full range of unique investment opportunities. But this story is changing as policymakers seek to liberalise Chinese stock and bond markets to allow greater access to onshore Chinese investments.

-

Special Report

Special ReportEnhanced index strategies offer the best of both worlds

Passive investing strategies have been some of the biggest beneficiaries of above-average equity market performance over the past decade: they produced strong returns for investors without needing to take any active risk to generate performance.

-

Special Report

Special ReportThe European bond market is modernising

The European bond market is modernising at a rapid pace, and fixed income exchange-traded funds (ETFs) are playing a crucial role in driving this progress. ETF liquidity, price transparency and versatility are propelling many of the developments we see in the market today and are supporting a more robust and structured bond ecosystem.