Latest from IPE Magazine – Page 88

-

Features

FeaturesBriefing: Why gold is different

Why does gold behave so differently from industrial metals and, indeed, most commodities in general? Despite the obvious contrasts – such as its shininess and its use in jewellery – it is not immediately clear why this should be the case.

-

Features

FeaturesStrategically speaking: Goldman Sachs Asset Management

If you are a pension fund, insurer or sovereign wealth fund and you haven’t heard from Goldman Sachs already, it probably won’t surprise you to learn that they want to talk to you – about a variety of alternative investment opportunities they want to put your way as a potential debt or equity fund investor, co-investor or all three.

-

Features

FeaturesFixed income, rates, currencies: Market signals cloud the picture

From preliminary data, Europe’s second-quarter growth appears to have been surprisingly strong, seemingly led by services, such as strong retail sales. Supply-side problems are still constraining the goods sector generally, hitting the German economy especially, with industrial production falling more than one percentage point over the second quarter.

-

Features

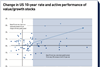

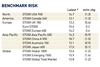

FeaturesAhead of the curve: Will rising rates see value stocks win?

There is growing global anticipation that central banks are likely to increase short-term rates. The spectre of inflationary pressure on longer-term rates looms large. What does this mean for value and growth stocks? Value might be expected to come up top and growth to lose out. But this is not the whole story. We examined stock returns during several historical periods of rate increases in the US and UK to see which factor would ultimately come out on top, and when.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - September 2021

The delta variant has caused a new COVID-19 wave in many places but it is different in character from previous ones. New hospital admissions are typically from among the unvaccinated. The average age of COVID patients has also come down significantly. In western Europe, the current wave seems largely under control, albeit at higher levels in the old EU member states.

-

Special Report

Special ReportIreland: Counting the cost of new rules

Ireland has finally transposed the European Union’s IORP II directive – but there is a long and potentially expensive path ahead to full implementation

-

Special Report

Special ReportItaly: Reform season lies ahead

Italian policymakers are discussing further changes to the pension system but are reluctant to address the fundamental problems

-

Special Report

Special ReportNetherlands: What a difference a year can make

Dutch pension funds funding ratios have made dramatic recovery over the past 12 months

-

Special Report

Special ReportNorway: Moves to boost occupational pension payouts

Government proposals seek to strengthen right to pensions for all workers and maximise returns from schemes

-

Special Report

Special ReportPortugal: Social security fund targeted as COVID bites

Many retirees continue to receive pensions below the poverty line as Portugal continues to turn grey

-

Special Report

Special ReportSpain: First phase of pension reform finally kicks off

Government and social partners agree on a package of measures after a decade of discussion

-

Special Report

Special ReportSweden: Occupational pension company route gains popularity

Some pension providers and funds are opting to align with IORP II rules rather than the Solvency II-based regime

-

Special Report

Special ReportSwitzerland: Rule changes widen investment choices

New regulations may give pension funds the ability to allocate beyond current limits

-

Special Report

Special ReportUK: Funding challenges amid continued market uncertainty

The UK’s pension regulator emphasises the need for schemes to focus on long-term planning, transparency and risk management

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Credit report

As the institutional investment community heads towards a post-COVID new normal, private credit remains a favourite among investors despite inflationary headwinds. In this report, we also cover the record amounts of capital raised by private-debt funds last year, the latest developments ESG in private markets, and how the digital transformation accelerated by COVID is impacting private debt.

-

Country Report

Country ReportCountry Report: Pensions in Italy

Italian pension funds are growing their allocation to illiquid asset classes at an increasing pace, spearheaded by a number of innovative institutional collaborations. In addition, the sector is more and more making investment choices with ESG factors in mind, as we analyse in our latest in-depth on Italy’s pensions. The report examines the impact of COVID-19 on the health of the country’s second-pillar pensions system, and finds why its future growth is dependent on more decisive policymaking.

-

Country Report

Country ReportPrivate markets: Seeking post-COVID alternatives

Italian pension funds continue to invest in private markets ahead of a potentially promising post-Covid recovery phase

-

Features

FeaturesPrivate credit: Floating to safety

Despite inflationary headwinds, the outlook for private credit remains strong