Latest from IPE Magazine – Page 9

-

Opinion Pieces

Opinion PiecesGermany’s pension buyout market evolves

The pension buyout market in Germany is gradually evolving. Transactions to transfer companies’ liabilities to pension corporations (Rentnergesellschaften), the vehicle used for buyout deals, have occurred regularly in the first half of this year.

-

Opinion Pieces

Opinion PiecesEurope must forge its own trade relations policy with China – without relying on the US

Iran has recently been in the headlines, but while its relations with the US have ramifications across the Middle East, the more profound longer-term issue may be America’s relationship with China, as Washington beats the drum of a new cold war with Beijing.

-

Opinion Pieces

Opinion PiecesShould UK pension funds re-embrace home investment bias?

UK pension funds could be part of a broader, coordinated investment drive to fuel the growth of the country’s internationally unloved small and mid-cap companies

-

Features

FeaturesFixed income, rates, currencies: Questions over US economic policy dominate global concerns

As ever, the US dominates the global economic landscape. While there is still considerable uncertainty around possible tariffs emanating from the US – despite deals struck by the UK, China and Vietnam – the levels are still expected to be markedly lower than those trumpeted on 2 April.

-

Features

FeaturesIPE Quest Expectations Indicator - July 2025

US President Donald Trump remains the main source of global political risk. In recent weeks, he has ramped up pressure on Russia over the ongoing war in Ukraine while the success of his interventions in Israel’s dual conflicts with Hamas and Iran is uncertain.

-

Features

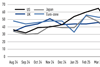

FeaturesChart watch: Uncertainty following tariff announcements persists

Though much of the damage caused by the so-called 2 April ‘Liberation Day’ announcement of US tariffs has been repaired, uncertainties generally remain high.

-

Features

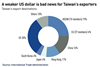

FeaturesUS Dollar slide set to continue amid ongoing geopolitical turbulence

The US dollar (USD) index tumbled 10% in the first six months of the year, marking the worst performance since 1973 when Richard Nixon was the US president and the greenback broke its connection with gold.

-

Interviews

InterviewsPinnacle Investment Management: ‘You need an absence of distractions’

Ian Macoun was all set to continue an illustrious career in traditional fund management when he decided to change tack.

-

Interviews

InterviewsPension funds eye higher private credit exposure in search of yield

Lured by its high returns and continued strong outlook, pension funds are considering increasing their exposure to private credit amid a fast-evolving landscape

-

Opinion Pieces

Opinion PiecesItalians must raise awareness about second-pillar pensions

Giorgia Meloni’s government has failed to revitalise the Italian second-pillar pension system. But credit to the pragmatic right-winger who in 2022 became Italy’s first female head of government – at least she tried.

-

Opinion Pieces

Opinion PiecesTime for some straight talking on ESG matters

Catherine Howarth, chief executive of campaign group ShareAction, expects more of asset owners.

-

Opinion Pieces

Opinion PiecesRethinking diversity: the overlooked value of cognitive differences

Over recent years, the term ‘diversity’ has been stretched in so many directions that its meaning risks becoming lost. The original common-sense goals – improving decision making, widening access to talent and ensuring equal opportunity – have become lost amidst a politicised battle.

-

Features

FeaturesEuropean Commission eyes securitisation as way to boost EU’s economy

After years of being discussed as a way to boost the European Union’s economy, securitisation is now firmly at the top of policymakers’ priority list for the 2024-29 legislative term.

-

Opinion Pieces

Opinion PiecesEurope’s nasty pension tax dilemma

The Nobel Prize-winning economist Bill Sharpe famously once said that retirement drawdown is the “hardest, nastiest problem in finance”. In EU politics, the same thing could pretty much be said about taxation.

-

Asset Class Reports

Asset Class ReportsAI in private credit: from hype to practical advantage in portfolio monitoring

Private debt fund managers do not tend to use AI in portfolio management, but this could be about to change

-

Interviews

InterviewsFondoposte: New investment strategy, same values for Italian postal workers' pension fund

Antonio Nardacci, chairman of Fondoposte, the pension fund for Italian postal workers, speaks to Luigi Serenelli about the fund’s revamped offering, its domestic investments and ESG

-

Research

ResearchIPE institutional market survey: Managers of Italian institutional assets 2025

Domestic players continue to dominate Italy’s insurance-heavy €787bn institutional asset management market, with Generali Asset Management, Intesa Sanpaolo’s Eurizon and Banco BPM’s Anima taking the top slots.

-

Opinion Pieces

Opinion PiecesUS budget bill battle fazes Australian super funds

With around A$750bn (€420bn) allocated to the US, Australian super funds are bracing themselves for the impact from a raft of policies being rolled out by the Trump administration.

-

Special Report

Special ReportIPE Top 500 Asset Managers 2025: Record growth in a winners-take-all asset management market

The world’s asset managers have enjoyed three straight years of robust growth, but a transformative trend is gaining momentum – AUM growth is increasingly concentrated at the top.

-