Latest from IPE Magazine – Page 92

-

Opinion Pieces

Opinion PiecesThe recovery does not eliminate systemic risk

The world’s economy is already recovering from the damage inflicted by the lockdown measures imposed to contain the spread of COVID-19 in 2020.

-

Opinion Pieces

Opinion PiecesEstablishing a sustainable path

Investors increasingly want to take a more environmentally, socially and governance-conscious approach to investing. Despite the growing choice of ESG strategies, the wide range of products and a lack of uniformity can make it difficult to compare the options.

-

Interviews

InterviewsOn the record: Stewardship in action

IPE asked three pension funds about their stewardship strategies and agendas ahead of the 2021 AGM season

-

Opinion Pieces

Notes from the Nordics: GPFG brought into politics

The Norwegian Government Pension Fund Global (GPFG) is a phenomenon – the world’s largest sovereign wealth fund owned by a population of just 5.3m, accounting for a sixth of all SWF assets and the owner of 1.5% of all listed equities.

-

Opinion Pieces

Opinion PiecesIncorporating climate change within investment portfolios

Recording the possible impacts of climate change on investment portfolios is becoming a regulatory and reporting requirement. Asset managers and asset owners will need to incorporate it into future management information and reporting systems.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Coalition mulls super hike

There are arguments both for and against a rise in compulsory superannuation contribution rate as Australia emerges from the COVID-19 pandemic .

-

Opinion Pieces

Opinion PiecesLetter from US: The rise of the new alternatives

Pension funds and other institutional investors used to invest in hedge funds aspiring to outperform public stock and bond benchmarks. Now, after years of disappointing performances, they have changed their attitude. They still invest in hedge funds, but the new expectation is simply to get a few percentage points above the return on zero risk investments.

-

Features

Accounting: Getting there eventually

You could be forgiven for thinking that audit reform has a lot in common with online shopping: knowing what you want is the easy part – it is fulfilment that is the let-down.

-

Features

FeaturesPerspective: Nicolai Tangen & NBIM

Less than a year after his controversial appointment, criticism of Nicolai Tangen’s leadership of Norges Bank Investment Management is building

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Principles for setting CEO pay

As we emerge from the AGM season, executive pay has, once again, been a lightning rod. Often pay is presented in simple headline numbers and narratives, but, in fact, pay is among the most complicated issues that percolate to board level. In my experience of sitting on boards for more than a decade, there are several principles that should guide the best global companies in setting executive pay.

-

Features

Briefing: Credit-risk niche gains interest

In a world of prolonged low interest rates, institutional investors are scouring different pockets of the investment landscape to generate additional returns. One area is capital regulatory transactions, which are far from new but are being put under the microscope for their potential as part of an alternative credit portfolio. However, these transactions can be more complex than other alternative credit asset classes and require specialist expertise, skills and understanding.

-

Features

FeaturesBriefing: China bonding with the world

It is tantalising to imagine the concept – that the standard global fixed-income portfolio, which has stood the test of time for so long, may be about to unravel. The standard bearers – US Treasuries, the UK Gilts, German Bunds and Japanese government bonds (JGBs) – may soon have to share the stage with a brash newcomer: Chinese government bonds (CGBs).

-

Features

FeaturesFixed income, rates, currencies: Still missing the target

Most would agree that one data release from an important but volatile dataset – employment figures – should be read with caveats. However, the scale of the forecasting ‘miss’ for April’s US job numbers was hard to dismiss as just noise.

-

Features

FeaturesAhead of the curve: Crypto assets

It is no longer prudent to ignore the potential of crypto assets

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - June 2021

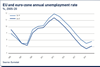

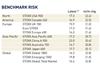

The UK experience with vaccination suggests that COVID-19 case numbers start falling when about half the population is immunised. The US will soon reach that level. The EU is over the 30% mark while Japan is at 3%. Taking the BRIC countries as a proxy for emerging markets, Brazil scores 16%, while Russia and India have reached about 10%. China has not published its vaccination figures. Meanwhile, new strains remain a source of concern.

-

Analysis

AnalysisBridgewater: Fluent in risk, return… and impact

Bridgewater Associates, one of the most prominent macro hedge funds, is reflecting the integration of sustainability in its research process with two senior appointments.

-

Opinion Pieces

Opinion PiecesAbundant opportunity… and risk

In case you needed reminding, both China’s equity and fixed-income markets are the world’s second-largest after the US.

-

Country Report

Country ReportCountry Report – Pensions in UK (May 2021)

The UK’s Pension Schemes Act was finally signed in February 2021, after nearly two years of negotiations in parliament that were severely disrupted by elections, Brexit-related negotiations and the COVID-19 pandemic. The new rules have given the Pensions Regulator (TPR) new powers that could see it intervene in corporate actions such as mergers and acquisitions, as we analyse in this report. The report also looks at other key topics impacting the UK pensions sector, including DB funding, climate change, risk management and pension dashboards.