Latest from IPE Magazine – Page 94

-

Special Report

Special ReportSocial enterprises: Social return guaranteed

The European Social Innovation and Impact Fund is a pioneer in social enterprise finance

-

Country Report

Country ReportDB funding – a mixed recovery story

Last year brought both operational and financial challenges for defined benefit schemes but some have come out looking better for it

-

Special Report

Special ReportImpact bonds: Clipping the impact coupon

High risk, costs and complexity have hindered the development of impact bonds. Could this be about to change?

-

Country Report

Country ReportPension dashboards – a need for clarity

Dashboards hold out the promise of allowing individuals to see all their retirement savings on one digital platform

-

Features

FeaturesLong term matters: Is your board colluding with E(rratic) S(uperficial) G(reenwash)?

ESG is booming, but the industry risks becoming complacent. Fund managers are creating new products that meet markets’ needs more than those of society and the thin ‘layer’ of ESG in core investment processes is not contributing to the much-needed transformation of our economies and societies.

-

Interviews

InterviewsOn the record: The inflation question

IPE asked three pension funds about their outlook for inflation and how they would seek to adapt their fixed-income strategies to a new rates environment

-

Interviews

InterviewsHow we run our money: Bayer-Pensionskasse

Stefan Nellshen (pictured), CEO of the Bayer-Pensionskasse, tells Carlo Svaluto Moreolo about the fund’s ALM approach

-

Interviews

InterviewsInterviews: Technology - the way forward

Pension funds and consultancies face multiple challenges in harnessing rapidly developing technology to meet their needs

-

Interviews

InterviewsStrategically Speaking: Cardano

The central argument of the 2015 documentary ‘Boom, bust, boom’, which features several high-profile experts including Nobel laureates Paul Krugman, Robert Shiller and Daniel Kahneman, is that financial crises are natural events caused by human nature.

-

Features

FeaturesAhead of the curve: Occupation could trump sex

There remains a great deal of popular debate about such things as the sex-linked glass ceiling, cliff, escalator and the ‘sticky’ floor, all of which imply that career opportunities are different for men and women.

-

Special Report

Ocean finance: The $24trn ‘blue’ economy

Ocean-focused investment funds are piquing investor interest as awareness of the importance of maritime ecology increases

-

Interviews

InterviewsInterview: Amlan Roy, Head of Global Macro Research, SSGA

Amlan Roy holds no truck with the popular view of demography that most readers will recognise. That is the oversimplified model that focuses on an ageing population placing an intolerable burden on the public finances

-

Opinion Pieces

Opinion PiecesAfrica offers Europe opportunities

In 2015, Europe faced the prospect of a million Syrian refugees fleeing from civil war, attempting to cross into its borders. The sudden influx created a political as well as a humanitarian crisis with Hungary building a 175km-long fence to prevent crossings from the Balkans.

-

Opinion Pieces

Opinion PiecesLetter from Australia: A question of gender imbalance

Statistics offer a snapshot into the real world and they reveal a depressing picture of gender inequality in Australia’s superannuation system.

-

Opinion Pieces

Opinion PiecesLetter from US: Aid without reform set to resolve the multi-employer pension plan crisis

Until March, The prospective collapse of multi-employer pension plans meant that over one million retired truck drivers, shop assistants, builders and other members of 186 schemes were at risk of losing their retirement benefits.

-

Features

Reporting: Yours sustainably…

You know how one thing can lead to another? Well, that is what happened with the International Financial Reporting Standards Foundation’s steps into sustainability reporting.

-

Features

FeaturesPerspective: APG & E Fund in China

APG’s partnership with E Fund Management has produced tangible results

-

Opinion Pieces

Opinion PiecesGuest Viewpoint: Pension funds are key to the recovery from COVID-19

The unprecedented situation resulting from the COVID-19 pandemic has shown that pension funds serve a key social function in supporting economies and citizens, ensuring benefits for old age income.

-

Features

FeaturesActive management: More than just a stopped clock

When most active managers underperform, how can investors identify the few who are likely to consistently outperform?

-

Features

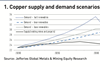

FeaturesNet-zero opportunities: Global green momentum boosts prospect of a mining super cycle

The Covid-19 pandemic has given everyone pause for thought. It has also been a catalyst for action. For some, global warming seemed like a nebulous, distant concern. But the fragility of life on earth has been laid bare.