Latest from IPE Magazine – Page 95

-

Features

FeaturesFixed Income, Rates, Currencies: A false start

While we may be approaching that ‘exit from pandemic’ moment, the exceptional monetary and fiscal responses from policymakers ensure COVID-19’s economic legacy will be felt globally for years to come.

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - May 2021

COVID-19 infection rates are still rising in the US and Japan, hopefully on the verge of decreasing in the EU and low in the UK. The positive trend in global infection rates is more than undone by a strong rise in infections in parts of Asia. With the exception of the UK and Israel, vaccination has not progressed to the stage where it has a discernible influence on infection rates.

-

Special Report

SDG reporting: Beyond SDG-washing

Only thorough processes and due diligence can make sense of the welter of claims and frameworks by companies using the SDGs as a reporting tool

-

Special Report

Special ReportInterview: Pavan Sukhdev

Pavan Sukhdev, CEO of GIST Advisory, describes his firm as being at the “intersection” of technology and sustainability.

-

Book Review

Book ReviewBook review: Shooting for the moon

Mariana Mazzucato calls on us to reformulate capitalism itself, and to return to the ‘Big Government’ rejected by the baby-boomer generation

-

Opinion Pieces

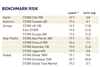

Opinion PiecesEquities to the fore as an inflation hedge

At a time when institutions can deploy billions swiftly at the touch of a few buttons, there is increasing focus on deploying capital well. A notable buzzword of late has been ‘resilience’ as pension funds look to downside risks.

-

Special Report

Special ReportSpecial Report – Manager selection

In this special report, we analyse the shift in priorities when it comes to selecting real assets and private equity managers, with ESG representing a ‘make or break’ for some investors. We also talk to two leading investors – the UK’s University Superannuation Scheme (USS) and Sweden’s Tredje AP-fonden (AP3) – about their approach to manager selection and due diligence.

-

Country Report

Country ReportCountry report – Pensions in Germany (March 2021)

Social partner pensions are just one of the new defined contribution (DC) pension arrangements which have emerged in Germany in the past three year and more more could follow, as we analyse in this report. Will this bring a boost to the country’s neglected second pillar? We also look at pension risk management and find how investors are evolving to adapt to new realities in terms of assets and liabilities, and assess why German politicians are looking abroad for ways to boost exposure to equities in long-term savings.

-

Asset Class Reports

Asset Class ReportsAsset class report – Fixed income & credit

As the world still grapples with the implications of the COVID-19 pandemic, credit investors continue their search for attractive yields in an environment where liquidity, even for long-term investors, could become critical. In this report, we look at different aspects of the fixed income & credit universe, including multi-asset credit strategies, the changing US high yield market, and the opportunities for institutional investors in trade and supply-chain finance.

-

Features

FeaturesInflation strategy: Conditions look ripe for a new commodities supercycle

The media briefly got excited when the followers of Reddit – a social news website often used by political activists – ineffectually attempted to ramp up silver prices in February. But news about commodity prices other than oil and gold rarely make headlines. For most institutional investors, commodities are a Cinderella asset class. A fleeting moment in fashion before the 2008 global financial crisis (GFC) has been superseded by widespread indifference.

-

Opinion Pieces

Opinion PiecesHopes for coherence in sustainability disclosures regulations

It could have been done differently, but, nonetheless, a clear path is emerging as to how EU sustainable finance regulations will become more of a coherent whole. The problem that has been perceived and outlined time and time again by investor groups is that disclosures are being asked of their constituencies – asset managers, pension funds – for which the data is not really available, or only at a significant cost. Tough, some may say, get on with it.

-

Country Report

Country ReportSocial partner pensions: An overlooked model

Just one new DC-type arrangement has emerged in Germany in the past three years. More could follow, bringing a boost to Germany’s neglected second pillar

-

Special Report

Special ReportPrivate markets: A shift in priorities

The COVID-19 pandemic has modified the selection process for managers of real assets and private equity

-

Asset Class Reports

Asset Class ReportsMulti-asset credit: Switching tactics to deal with volatility

MAC strategies allow investors to shift investments tactically to capitalise on a wide range of niche markets

-

Features

FeaturesSelectivity is key in SPAC market

The vogue for special purpose acquisition companies (SPACs) has something in common with many other fashions, whether in investment or in the shops. Just when you think the trend cannot get even hotter, the temperature rises yet further.

-

Country Report

Country ReportPension Risk Management: Dealing with a challenging year

German pension investors are evolving to adapt to new realities in terms of assets and liabilities

-

Special Report

Special ReportUSS & DiligenceVault: Digital platform eases process of due diligence

USSIM reports positive experience using DiligenceVault’s platform to carry out due diligence of asset managers

-

Opinion Pieces

Opinion PiecesGreen ambitions to drive recovery

Last month, Italy announced its first foray into the hot market of green bonds by raising a record €8.5bn (see page 9).