Latest from IPE Magazine – Page 99

-

Country Report

Country ReportCountry report – Pensions in Ireland (February 2021)

In 2018, the Irish government published its “Roadmap for Pensions Reform”, which set out plans for a national auto-enrolment system to be implemented for 2022. The implementation of changes has been dogged by delays, with COVID-19 joining the long list of obstacles slowing the country’s pension reform, as we analyse in this report. We also look at how volatile financial markets have impacted funding levels of defined benefit (DB) pension schemes, and explore the potential of the new regulated investment limited partnerships for institutional investors in private assets.

-

Special Report

Special ReportSpecial Report: European Pension Funds’ COVID Response

We also analyse how public development banks are going beyond their traditional remit, with a focus on post-COVID recovery, tackling climate change and meeting the UN Sustainable Development Goals.

-

Opinion Pieces

Opinion PiecesThe world is approaching an inflection point

Domestic challenges and US political developments have proved such a preoccupation recently that it has been all too easy to miss a key global shift. China’s rise to global prominence has accelerated markedly as a result of the past year’s events.

-

Country Report

Country ReportA long and winding road

COVID-19 joins the line of obstacles slowing Irish pension reform plans

-

Special Report

Special ReportOn the record: The path to recovery

Six major pension investors chart the risks and opportunities ahead as the world moves into a recovery phase

-

Asset Class Reports

Asset Class ReportsHedge funds and distressed debt: Competition for assets will be fierce

Hedge funds will have to compete with private equity and credit funds for distressed opportunities following the pandemic

-

Opinion Pieces

Opinion PiecesCOVID-19 barely tested the financial system

The financial system seems to have coped well with COVID-19. This is despite the repeated recent warnings about a build-up of systemic risk. In turn this has been linked to the abundance of cheap debt and the growth of the asset management industry.

-

Country Report

Country ReportDB funding: Small rise in funding levels

Volatile financial markets continue to cause significant headaches for pension schemes

-

Special Report

Special ReportDevelopment banks evolve

Development banks are going beyond their traditional economic remit to embrace tackling climate change and meeting the UN’s Sustainable Development Goals

-

Opinion Pieces

Opinion Pieces‘Close contact’ needed amid pandemic

Multiple lockdown restrictions have brought about a simpler way of working for some – remotely from home for most – but for institutional investors it also meant coming up with strategic models that could maintain the quality of asset managers’ due diligence – existing or potential.

-

Country Report

Country ReportIAPF view: Positive aspects in a year of upheaval

There are signs that a significant movement towards pensions reform in Ireland could take place this year

-

Country Report

Country ReportHigh hopes for new ILP Act

The new types of funds should be the vehicle of choice for investment in private assets

-

Interviews

InterviewsHow we run our money: Local Pensions Partnership

Chris Rule (pictured), CEO of the £19.7bn Local Pensions Partnership (LPP), speaks to Carlo Svaluto Moreolo about building an in-house investment management outfit

-

Features

FeaturesPerspective: Targeting net zero

Ambitious ‘net-zero’ carbon reduction goals are the latest in the evolution of asset owners’ engagement with climate change

-

Opinion Pieces

Opinion PiecesThe pandemic end-game

Overcoming COVID-19 and ensuring no recurrence is proving to be a formidable challenge for the global economy. The worst may still lie ahead. Even health systems in developed markets are creaking at the seams with the second and third waves of the pandemic. More transmissible mutations of the virus are making the task even harder.

-

Features

Accounting Matters: Auditing the auditors

There is widespread consensus that the audit sector is not fulfilling its potential, and that previous attempts at reform have been ineffective. As the impact of high quality audit goes far beyond the boardroom, when pension funds rely on audited financial statements for their capital allocation decisions, it is ultimately their individual members’ capital that is at risk.

-

Features

FeaturesLong-term matters: Stop investing in autocracy

Europeans observing the US ‘near miss’ constitutional crisis have a choice – be spectators or show responsibility

-

Opinion Pieces

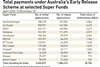

Opinion PiecesLetter from Australia: Early access genie escapes the bottle

In March 2020, as the Australian economy went into COVID-19 lockdown the government unlocked the national superannuation pool, seeking to ease the financial stress on individuals.

-

Opinion Pieces

Opinion PiecesLetter from US: HSAs set to build on popularity

The Health Savings Account (HSA) is becoming increasingly popular as a retirement savings vehicle in the US. The new Biden presidency and the now Democrat controlled Congress are likely to accentuate this trend in 2021 and beyond.

-

Opinion Pieces

Opinion PiecesGuest viewpoint: David Neal, IFM Investors

While COVID-19 continues to hit the global economy, governments are looking to infrastructure as a way to create future employment and sustain the eventual economic recovery