Latest Special Reports – Page 34

-

Special Report

Research: Europe has turned a corner

Asset managers must cater to the trend to deeper ESG investing to remain competitive Key points ESG investing in Europe has developed over more than three decades There are four broad categories of ESG investment – exclusion, integration, stewardship and impact Integration is the most widespread approach ...

-

Special Report

Special ReportIceland: From strategy to practice

Several factors are pushing Icelandic pension funds towards responsible investment

-

Special Report

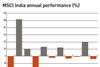

Special ReportIndia: Still early days

The growing adoption and importance of ESG criteria among Indian firms could have implications for companies such as rice producers

-

Special Report

Mining the ESG vein

ESG used to be an optional extra in the mining industry but governments are starting to mandate minimum standards through legislation

-

-

Special Report

Market Update: The ETF boom continues

Around the world, exchange-traded funds (ETFs) continue to grow in assets and importance, breaking records along the way.

-

Special Report

Market Update: The competitive battle intensifies

Despite the growth in European ETF assets, issuers are facing margin pressure caused by fee cuts.

-

Special Report

Market Update: The drum beats on: ETFs for the ongoing trade war

This time last year, we were looking at how trade relations between the US and China might play out and the best way to position a portfolio – especially in terms of sectors – according to which scenario an investor thought was most likely.

-

Special Report

Market Update: Can European ETF assets double again?

Earlier this year, ETFs and ETPs listed in Europe celebrated a record 55 consecutive months of net inflows, only 19 years after the first ETFs in Europe were launched.

-

Special Report

Liquidity & Implementation: Woodford fallout renews focus on ETF risks

The recent suspension of redemptions from Neil Woodford’s Equity Income fund is a cautionary tale and one that has further sharpened the spotlight on the liquidity of mutual funds, a category that includes exchange-traded funds (ETFs).

-

Special Report

Liquidity & Implementation: Liquid beta sleeves: bespoke solutions with index building blocks

Liquidity in a pension fund context can mean a number of things. As long-term investors, pension funds can harvest the illiquidity premia by investing in private markets, which they have been doing increasingly over the past 10 years.1 On the other hand, pension funds are required to meet their liabilities and so need enough liquidity to ensure the payment of benefits to members.

-

Special Report

Liquidity & Implementation: Will all mutual funds become ETFs?

It took almost five years, but the US regulator still surprised many in the exchange-traded fund (ETF) industry when it gave preliminary approval to Precidian Investments’ ActiveShares in May.

-

Special Report

Liquidity & Implementation: A cost comparison: futures versus ETFs

In this article, we use a cost comparison framework to contrast index futures (CME Group’s E-mini S&P 500 index futures) and three popular US-listed exchange-traded funds (ETFs) tracking the same index – SPY, VOO and IVV.

-

Special Report

Liquidity & Implementation: The shifting sands of index provision

As ETFs are created to track ever more specialised market exposures, competitive pressures and new regulations are impacting the complex relationships between asset managers and index providers.

-

Special Report

ETFs for ESG: Why passive makes sense for ESG

ESG investing – the incorporation of environmental, social and governance (ESG) factors into investment criteria – has grown rapidly in recent years.

-

Special Report

ETFs for ESG: The ESG governance challenge

An increasing number of institutional investors are interested in investments with an environmental, social and/or governance (ESG) focus.

-

Special Report

ETFs for ESG: Sustainable investing is here to stay

Sustainable investing was once viewed as a trade-off between value and ‘values’. Yet today, it’s something investors can no longer afford to ignore.

-

Special Report

ETFs for ESG: The devil in the detail of ‘low carbon’ ETFs

Sustainable market indices are nothing new. The Dow Jones Sustainability index was launched in 1999 and the FTSE4Good index in 2001.

-

Special Report

ETFs for ESG: Corporate governance for passive investors in Japanese equities

The Japanese economy has been experiencing significant and positive change since the election of Prime Minister Shinzo Abe in 2012. After a sustained period of economic stagnation, Japan’s return to growth is being fuelled by Abe’s transformative economic policies.

-

Special Report

ETFs for ESG: Gender equality ETFs gain a foothold

Can a new category of ETFs help address one of the oldest economic imbalances of all?