Latest Special Reports – Page 35

-

Special Report

Focus on Fixed Income: The rise and rise of fixed income ETFs

When ETFs first broke up the active management party in the fallout of the financial crisis, it was equity funds that bore the brunt of the impact.

-

Special Report

Focus on Fixed Income: ETFs: the natural home for fixed income

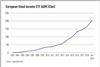

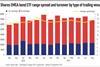

In recent years, fixed income ETFs have been grabbing a larger slice of the ETF market as investors look to capitalise on the enhanced diversification, tradeability, price transparency and liquidity they can provide to bond portfolios. According to the latest research by Citi Business Advisory Services, fixed income ETF assets have increased at a robust 25% annual compound growth rate over the last decade, hitting more than $870bn by the end of 2018.

-

Special Report

Focus on Fixed Income: Do fixed income ETFs distort the market?

In this article, which is an excerpt from a recent State Street Global Advisors publication, we address one of the key misconceptions about fixed income (bond) ETFs – namely, that they have become so large that they are distorting the underlying bond market. Instead, we argue, despite their recent growth, fixed income ETFs represent a relatively small proportion of the world’s debt markets.

-

Special Report

Focus on Fixed Income: Bond ETFs, the Swiss army knife in a time of need

Fixed income will play both a pivotal and multi-faceted role in European pensions scheme portfolios. Whether it be for growth, income or liability and cash flow matching, many schemes in the region will need to hold bonds as they de-risk in a low yield environment.

-

Special Report

Focus on Fixed Income: Actively managing today’s green bond opportunities

In this article we examine the process for green bond labelling and certification and its implication for index investors. Passive (index-tracking) green bond funds are bound by eligibility rules and each index has its own labelling requirements.

-

Special Report

Markets & Regions: Factor investing in commodities: a sector-based approach

Commodities have long been a staple of multi-asset investors. Traditionally used to diversify exposure to fixed income and equity holdings, they are more recently also a source of alternative risk premia. Whatever the use case, the desired feature of any commodities allocation is some combination of attractive performance, sufficient liquidity, and a transparent methodology.

-

Special Report

Markets & Regions: China unleashed: taming the dragon through ETFs

Despite its favourable fundamentals and widely acknowledged growth potential, China continues to be under-owned by most global investors.

-

Special Report

Innovation: What could disrupt ETFs?

Over the last two decades, exchange-traded funds (ETFs) have been one of the most disruptive forces in the asset management industry. But could the tables be turned? In an era of excitement over the possibilities of financial technology (fintech), are ETFs vulnerable to being displaced themselves?

-

Special Report

Innovation: Bringing ETFs into the digital future

Over the past 18 months there has been an explosion in the number of ETFs focusing on new technology. From iShares to Ossiam, DWS to veteran investor Jim Rogers, it seems everyone has launched a fund based on how digitisation will revolutionise our lives.

-

Special Report

Special ReportManagement & outsourcing: The rush is on

Competition is intensifying among providers of data analysis and benchmarking solutions

-

Special Report

Special ReportChart of the Week: European pension assets exceed €7.7trn

IPE’s Top 1000 Pension Funds survey shows that total assets under management have increased despite market turmoil

-

Special Report

China: Crazy rich Chinese

Investing in the rise of China’s middle class might seem obvious but it is a complex process

-

Special Report

EU Sustainable Finance: The greening of Europe

The EU wants to encourage environmentally friendly investment practices. Will its taxonomy stimulate the green bond market?

-

Special Report

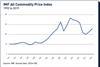

Financialisation: The commodities conundrum

It is an important practical question but it is hard to untangle how commodity prices are determined

-

Special Report

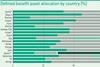

Top 1000 Pension Funds 2019: Asset growth in challenging times

The assets of the 1,000 largest European pension funds increased by 7% to €7.72trn in the last 12 months. This robust increase is set against a volatile backdrop in terms of asset prices and markets

-

Special Report

Viewpoints: Investment as the saviour

How taxonomy, trajectory and Ecolabel could save our children

-

Special Report

Rare earths: The building blocks of tech

Everything from batteries, visual displays, catalytic convertors to military hardware are reliant upon rare earths in their production. Unfortunately, investment opportunities in rare earths are not as widely available as their potential uses

-

Special Report

Special ReportHow fund managers view – and invest in – the rise of China’s middle class

Fund managers share their views on how China’s rising middle class is impacting the country’s economy and outlook

-

-

Special Report

Special ReportTechnology: The race is on

China’s rapid rise in the technology stakes is causing tension among other world-leading manufacturing countries