Latest Special Reports – Page 45

-

Special Report

Special ReportFactor investing & smart beta: What’s in a name?

Many smart beta ETFs are bought with the expectation of long-term market outperformance. The factors that many are based on have been proven both academically and empirically to produce excess returns

-

Special Report

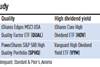

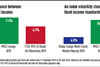

Factor investing & smart beta: Advances in factor-based fixed income indices

Global fixed income investors have benefited from a long bull market that began in the early 1990s

-

Special Report

Special ReportFactor investing & smart beta: The smart beta (r)evolution

The ability of stocks with certain investment characteristics to outperform the market has been well understood and documented for decades. But options of how to implement this strategy were limited

-

Special Report

Markets & regions: Spotlight on US equities

US equities have proven overwhelmingly popular with investors desperate for signs of economic growth

-

Special Report

Markets & regions: Using ETFs to position for a US–China trade war

Many media and market commentators believe that the potential US-China trade war could be one of the largest risks facing the global economy

-

Special Report

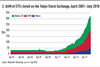

Special ReportMarkets & regions: The dynamic market in Japanese equity ETFs

Opinions of Japan as a market tend to be quite polarised and the country has looked cheap on a valuation basis for quite some time, both historically and relatively

-

Special Report

Markets & regions: How commodities strategies can help investors diversify their portfolios

In the current market environment, investors are looking for asset classes that can lower overall portfolio volatility without sacrificing returns

-

Special Report

Special ReportNew frontiers: Getting to grips with cryptocurrencies

For institutional investors and asset managers, crypto-currencies pose a triple dilemma

-

Special Report

New frontiers: Esoteric ETFs – egregious or genius?

From companies capitalising on cannabis decriminalisation to the streaming of Quincy Jones’s music, you can almost guarantee there is an ETF available to enable you to invest in it

-

Special Report

Regulation: Spotlight on liquidity, transparency and viability

ETFs may represent a tiny speck on the overall investment landscape but they are one of the fastest-growing products in the investment industry

-

Special Report

Special Report10 years since Lehman: Is asset management the next threat to financial stability?

The evidence of systemic risk in the asset management sector is limited but is kept under close scrutiny

-

Special Report

Special ReportFiduciary management: All-clear for UK consultancies

Regulators have eased concerns over competition within the UK investment consultancy and fiduciary management sectors

-

Special Report

Commodities: A boost for material benefits

Rising risk of inflation and geopolitical uncertainties are enhancing the role of commodities as a portfolio-diversifying strategy

-

Special Report

Special ReportTop 1000 Pension Funds 2018: A snapshot of a €7.2trn asset pool

The asset pool of Europe’s leading 1000 retirement funds now exceeds €7.22trn – a 2.49% increase over last year’s 4.45%

-

Special Report

Interview: Xiao Fu, Bank of China International

Xiao Fu, the head of commodity market strategy at the Bank of China International, talks about what will arguably be the biggest infrastructure project the world has ever seen

-

Special Report

Austria: Overcoming a troubled legacy

The challenge facing Austrian pension funds is their turbulent past rather than the new IORP II regulation

-

Special Report

Reflections on the crisis

IPE canvassed the views of leading economists and politicians on the post-Lehman crisis regulatory and policy response, and on the impact of the crisis on the global financial system

-

Special Report

Belgium: Portability pain

Belgium has been accused of ‘gold plating’ the EU portability directive