Latest Special Reports – Page 52

-

Special Report

Fixed income ETFs: the next frontier

Equity ETFs are still more popular, but fixed income products are catching up

-

Special Report

The next generation bond market

Fixed-income markets have undergone significant structural changes since the 2008 financial crisis. These seismic shifts are forcing investors to adapt to a new market paradigm

-

Special Report

Global regulators take another look at ETFs

The rapid growth of ETFs globally means that we are seeing increased official scrutiny of the sector

-

Special Report

Using ETFs for income investing

Many investors have traditionally associated passive investing with the headline values of indices and the resulting opportunities for capital growth. But over the last decade this approach has changed.

-

Special Report

Will ETF issuers create their own indices?

ETF providers are becoming attracted to the idea of developing bespoke indices and saving on licence fees

-

Special Report

Creating value through smart beta ETFs: myth or reality?

Smart beta ETFs can allow investors to benefit from the many positive attributes of both traditional passive and active strategies

-

Special Report

Indices, ETFs and governance

ESG concerns were once the remit of active and activist investors, but ETF and index providers are becoming increasingly vocal proponents of better corporate stewardship

-

Special Report

What makes the best ETF?

What makes the best ETF for one investor will be very different for another

-

Special Report

Active ETFs’ disclosure challenge

Active ETFs are still getting off the ground, representing just over 1% of the worldwide ETF market. Nevertheless, they are the focus of intense interest

-

Special Report

Attractiveness of local currency emerging market debt

Emerging market debt has become a core part of many investors’portfolios. Yet this asset class has also evolved rapidly

-

Special Report

Special ReportGerman Asset Management: A model for collaboration

Asset managers may work with insurers to gain business in Germany’s new defined contribution (DC) market

-

Special Report

Alternatives in demand

Universal-Investment’s latest investor statistics show how German institutions have started diversifying within alternatives

-

Special Report

Research costs: Managers wrestle with MiFID

Many German asset managers have yet to decide how to apportion external research costs

-

Special Report

Taxation: Changes ahead

What are the implications of the German Investment Tax Reform Law?

-

Special Report

Investment Solutions: No turning back

The way UK pension schemes receive investment advice could change following an investigation by the financial regulator

-

Special Report

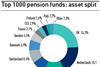

Special ReportTop 1000: A bird’s eye view of €7trn

The assets captured in IPE’s annual study of the leading European retirement asset pools total €7.04trn, up from €6.74 last year – an increase of 4.45%. Yet this growth in assets masks a varied picture

-

Special Report

MNOPF: Trustees must focus on their responsibilities

Rory Murphy, chair of the trustee board of the UK’s MNOPF, says the success of fiduciary management depends equally on managers and trustees

-

Special Report

Austria: Politics distracts from pensions

Pension reforms take second place to political squabbling