Latest Special Reports – Page 76

-

Special Report

Special Report ESG: Carbon Risk, a timeline

July 2011: The Carbon Tracker Initiative launches its seminal ‘Carbon Bubble’ report which, for the first time, puts the 2°C climate change target into a capital markets context…

-

Special Report

Special Report ESG: Carbon Risk, What if we could capture carbon?

There is a big question begged by the ‘stranded assets’ thesis: What if there were no link between burning fossil fuels and emitting greenhouse gases?

-

Special Report

Special Report ESG: Carbon Risk, Leaving smaller footprints

Bee-Lin Ang, Jonathan Williams and Martin Steward hear from pension fund investors around the world about why carbon and fossil-fuel risk matters, and how they are addressing it

-

Special Report

Special Report ESG: Carbon Risk, A low-risk path to carbon reduction

The low-carbon index approach adopted by AP4, FRR and ERAFP aims to mitigate climate change (and career) risk, writes Liam Kennedy

-

Special Report

Special Report ESG: Carbon Risk, How the low-tracking-error green index strategy works

As pioneered by the Swedish pension buffer fund AP4, low-tracking-error green indices work on a remarkably simple principle: weighting the stocks in each sector by carbon intensity (CO2 per unit of sales) and removing the most carbon-intense companies and exposure to stranded asset risk in intensity based on market cap.

-

Special Report

Special Report ESG: Carbon Risk, Not a binary choice

Paul Younger draws attention to the irreplaceable role fossil fuels play in many industrial processes, as well as their importance for economic development, to suggest that divestment is not necessarily a responsible course of action

-

Special Report

Special Report ESG: Carbon Risk, Two tactics are better than one

As investors come under increasing pressure on fossil fuels, Gordon Noble and Matthew Kiernan urge them to remember that divestment without engagement is as futile as engagement without the threat of divestment

-

Special Report

Special Report ESG: Carbon Risk, Accounting for carbon

To avoid putting garbage into the atmosphere, companies need to stop putting garbage into their accounts and investors need to stop putting garbage into their risk models. Elisabeth Jeffries finds a complex web of carbon disclosure protocols making that a big challenge

-

Special Report

Special Report ESG: Carbon Risk, Borderless potential

Energy security concerns have pushed international power connectivity up the European agenda. Jonathan Williams finds early pension fund investors attracted by stable cash flows in the low-yield environment

-

Special Report

Special Report ESG: Carbon Risk, Yielding results

Green, or climate bonds, are gradually becoming a mainstay in the market. Jonathan Williams assesses who is active in the market, whether it remains dominated by government-backed bonds – and who is assessing the impact of capital raised in this way

-

Special Report

Special Report ESG: Carbon Risk, How green are your govvies?

On the face of it, sovereigns and their debt should be very sensitive to carbon and climate-change risks. Mike Scott finds that uncertainty around data and the lack of a price for carbon is holding back the discounting of those risks

-

Special Report

Special ReportNorwegian oil fund offloads firms over environmental, human rights records

Sovereign wealth fund divests from three companies after concerns raised over environmental, ethical and human rights records

-

Special Report

Special ReportOracle board's refusal to engage with shareholders ‘untenable’ – PGGM

Dutch pension manager joined by Railpen in calling on US company to engage over governance concerns

-

Special Report

Special ReportSpecial Report, The M&A Cycle: When CEOs go shopping

The charts on this page, which you will find illustrating articles elsewhere in the January 2015 issue of IPE, tell of the M&A cycle that we explore in this month’s special report.

-

Special Report

Special ReportSpecial Report, The M&A Cycle: Big deals

Global M&A activity is increasing and mega-deals are leading the way. At a time when growth is sluggish and cash is piling up on balance sheets, Charlotte Moore looks at the trends in terms of regions, sectors and financing

-

Special Report

Special Report, The M&A Cycle: Commodity bust signals M&A wave in mining – for the right assets

Lower Chinese demand for raw materials and sluggish growth in most industrialised economies have forced mining companies into extensive repair work to bring capital structures and spending plans in line at the end of the ‘commodities supercycle’.

-

Special Report

Special Report, The M&A Cycle: Will it be different this time?

In the past, studies have questioned whether M&A adds long-term value and there is plenty of academic and anecdotal evidence of badly-botched integrations. “There are plenty of train wrecks out there,” as Steve Allan, M&A practice leader at Towers Watson, puts it.

-

Special Report

Special Report, The M&A Cycle: The M&A premium

There is no doubt that when M&A picks up, potential acquisition targets attract inflated bids. But Christopher O’Dea finds little evidence of a market-wide M&A premium, and even sectors that are usually targets are seeing prices driven much more by other factors

-

Special Report

Special Report, The M&A Cycle: Feeding frenzy

While European valuations have dipped recently thanks to growth fears, cash and equity-rich trade buyers are still competing for assets against the private equity titans like never before, finds Lynn Strongin-Dodds

-

Special Report

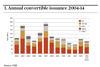

Special ReportSpecial Report, The M&A Cycle: Turning the ratchet

Convertible bonds are not only a good way for fixed-income investors to protect themselves against the ravages of M&A. Martin Steward and Anthony Harrington find that they are a great risk-managed way to exploit the cycle, too