All IPE articles in March/April 2025 (Magazine)

View all stories from this issue.

-

Features

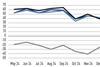

FeaturesIPE Quest Expectations Indicator - March 2025

Political risk has risen to boiling point. Donald Trump’s talks with Russia to end the war in Ukraine, without as much as a Ukrainian presence, left the US without allies or credibility, especially in Europe.

-

Country Report

Country ReportGermany country report 2025: New government faces choices on pensions reform

The collapse of Germany’s three-party coalition last year left behind a backlog of laws and proposals on pensions. What happens now?

-

Research

ResearchIPE institutional market survey: Managers of German institutional assets 2025

The IPE Germany Survey 2025 captures €2.1trn in assets managed on behalf of German institutional clients by 80 asset managers, including €468bn belonging to German pension funds.

-

Research

ResearchIPE institutional market survey: Emerging and frontier market equities managers 2025

The IPE Emerging & Frontier Market Equities Survey 2025 captures €789bn in assets managed in emerging market and frontier market equities by 49 global and European asset managers.

-

Features

FeaturesIPE Quest Expectations Indicator - April 2025

Since 1900, the US has waged numerous wars but has won only three without allies. This is the sobering background for recent US geopolitical policy moves: changing sides from Ukraine to Russia, interfering in German elections and behaviour at the NATO ministerial meeting.

-

Opinion Pieces

Opinion PiecesPlan fiduciaries wary of ESG investment criteria after American Airlines ruling

The US is experiencing a period of significant uncertainty across various sectors, including federal regulation of retirement plans. This uncertainty is being compounded by the increasing politicisation of environmental, social and governance (ESG) criteria in investing.

-

Opinion Pieces

Opinion PiecesDo artificial intelligence agents herald a brave new era in investments?

The artificial intelligence (AI) landscape is undergoing a profound transformation. While chatbots dominated the early phases of consumer AI applications, we are now witnessing a jump in AI evolution through the creation of AI agents.

-

Features

FeaturesAnother strong year ahead for green bond market as EU regulations set to drive demand

Against all the odds, the green bond market had a good 2024. In a year when inflows into global sustainability funds were slashed in half, green bonds recorded their second-highest annual issuance levels ever, with more than $560bn (€536bn) of labelled paper sold

-

Special Report

Special ReportArtificial Intelligence: UK pension funds optimistic but wary as they dip into AI

Trustees are exploring AI but emphasise the importance of understanding risks such as data security and ethical considerations

-

Special Report

Asset managers test AI’s power in the investment process

The AI revolution has come to asset management. Five leaders overseeing its rollout examine the state of play

-

Interviews

InterviewsE.ON: All charged up to build resilient investment portfolios

Stefan Brenk, head of asset management and pension finance at E.ON, tells Luigi Serenelli about the German utility’s approach to managing its pension assets

-

Features

FeaturesFixed income, rates, currencies: Trump’s tariff announcements weigh on sentiment

As tariff announcements garner huge amounts of media attention, financial market reactions have been muted. Participants are trying to beat off tariff fatigue and assess the best path through all the smoke and mirrors.

-

Analysis

AnalysisEuropean pension funds react to the anti-ESG backlash

Despite political and market headwinds, European pension funds remain firmly committed to achieving net-zero and long-term climate goals

-

Interviews

InterviewsEuropean pension funds, APK and Ilmarinen, stay loyal to emerging markets

Despite poor returns and rising geopolitical tensions, pension funds are maintaining some level of exposure to emerging markets – and even anticipate that opportunities will emerge

-

Special Report

Special ReportArtificial intelligence is transforming Asia’s financial sector

Asian markets are adopting AI at varying paces, but the potential for further development in the financial sector is significant, say experts

-

Asset Class Reports

Asset Class ReportsIs it time for private credit to step up on investing in artificial intelligence?

Besides digital and power infrastructure, investors are beginning to shift their focus to other areas of the burgeoning AI market

-

Interviews

InterviewsDaniel Gamba, NTAM: Scaling the heights of asset management

Daniel Gamba, president of Northern Trust Asset Management (NTAM), is sketching out a future for his business involving the mass customisation of products for clients and leveraging important client relationships to act as a key partner.

-

Country Report

Country ReportCan pension funds help German economy get back on its feet through investment in growth start-ups?

WIN, a government-sponsored initiative to boost investment in growth start-ups, has received widespread but not wholesale backing

-

Features

FeaturesCentral banks and cryptocurrency reserve: set for a breakthrough?

After courting the crypto community during his presidential campaign, Donald Trump issued an executive order in early March to create a US strategic bitcoin reserve, as well as a national digital assets stockpile of tokens other than bitcoin.

-

Opinion Pieces

Opinion PiecesGerman pension funds need to step up in fight to boost economic growth

Germany’s Christian Democratic Union (CDU) and Christian Social Union (CSU) parties, together with the Social Democratic Party (SPD), have now entered negotiations to form a new ‘grand coalition’ government