All IPE articles in May 2024 (Magazine) – Page 2

-

Features

FeaturesUK creates social factors template for pension investors

Environmental and governance risks receive much attention, but UK and other European institutional investors have focused less on social factors and their complexities.

-

Opinion Pieces

Opinion PiecesDefence is the new ESG question

Earlier this year, the European Commission launched its ambitious European Defence Industrial Strategy (EDIS). The main goals of the strategy are reducing fragmentation within the €70bn European defence industry and lowering weapons imports, thus increasing the EU’s military readiness. The success of the strategy would also contribute to economic growth.

-

Opinion Pieces

Opinion PiecesUS public pension funds focus on labour practices in private equity

Private equity has become dependent on public pension funds, which represent almost one-third of all investors in the asset class. These schemes invested 13% of their assets – over $620bn (€580bn) in 2022 – up from 3.5% in 2001 and 8.3% in 2011, according to data from public pension research non-profit Equable Institute.

-

Asset Class Reports

Asset Class ReportsFixed income: European high yield stands its ground

Investors flocked to the European junk bond market last year and despite a strong US economy, there is still appetite for European issuers

-

Asset Class Reports

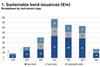

Asset Class ReportsThe quest for innovation in sustainable fixed income

Japan’s climate transition bond is the latest in a string of innovative developments in sustainable fixed income

-

Opinion Pieces

Opinion PiecesTime is running out for Germany's planned pension reforms

The German government is in the final stretches of an ambitious but tortuous journey to reform the three pillars of the pension system.

-

Opinion Pieces

Opinion PiecesSmall island states turn to institutional investors to protect oceans

Small island developing states may have a total population of only around 65 million, but through their exclusive economic zones they control about 30% of oceans and seas, according to the International Institute for Sustainable Development (IISD).

-

Features

FeaturesModelling shows net-zero investing can be profitable

Since the acceptance of the Paris Agreement in 2015, which bound nations to a legal commitment to reduce global temperatures, there has been a clear shift towards net-zero investing. While socially responsible investments are crucial for the mitigation of climate change, recent calls to row back on ESG funds suggest some hesitation.

- Previous Page

- Page1

- Page2

- Next Page