Investment in European equities by European asset managers has fallen by almost a third since 2015, according to the European Fund and Asset Management Association (EFAMA).

EFAMA’s 2024 Asset Management in Europe report shows that the share of listed equities issued in Europe held by investment funds domiciled in the euro area has declined by 10 percentage points, from 37% in 2015 to 27% at the end of last year.

Over the same period, the share of listed equities issued outside of Europe rose from 63% to 73%.

Euro-area investment funds are gradually shifting away from euro-area issuers and increasingly investing in shares issued outside the euro area, according to EFAMA.

“The story behind this trend of investment in shares issued outside the euro area by euro area investment funds could be due to the growing popularity of global equity funds, which are highly invested in equities outside the euro area, particularly in US tech”, said Vera Jotanovic, senior economist at EFAMA and one of the authors of the report.

However, expanding the analysis to discretionary mandates and European investment funds domiciled outside the euro area gave more promising results, added Jotanovic.

Overall, European asset managers hold €6.4trn of European Union-issued debt securities, or 28% of the total. They also hold €3trn worth of EU-issue listed shares, which corresponds to 27% of the total.

At the same time, the allocation to debt securities issued within the euro area by euro-area domiciled investment funds rose from 43% in 2014 to 50% at the end of last year.

“This is a picture of strong financing of the European economy by European asset managers, and it does not take into account the other asset classes they invest in”, said Jotanovic.

The figures mirror the trends with regard to investment in domestic equities. European asset managers reduced their allocation to domestic equities from 29.1% at the end of 2019 to 21.4% at the end of last year, according to EFAMA.

The allocation to domestic bonds also declined, from 36.8% in 2019 to 34.6% in 2022. However, European asset managers raised their allocation to domestic bonds to 36.8% last year.

EFAMA said that European asset managers’ allocation to domestic equities varies significantly between countries. It is as high as 50% in countries with smaller levels of assets under management, such as Turkey, Croatia, Greece, Poland and the Czech Republic.

Growing investment into the European economy, in order to raise its competitiveness, is at the top of the European Commission’s agenda, and European asset managers are seen as a key player in mobilising capital from private investors.

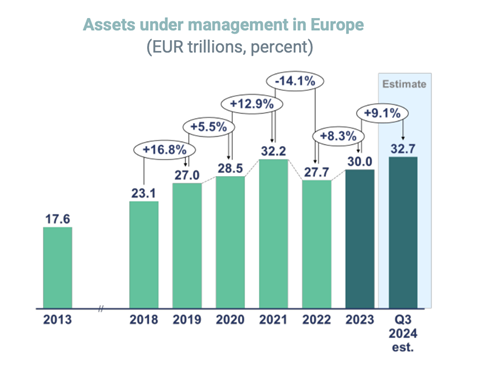

Overall, European asset managers held €30trn of assets at the end of last year, according to EFAMA’s report. Total assets under management grew 8.3% in 2023, thanks to rising equity and bond valuations.

EFAMA estimates that AUM in Europe will reach a new record of €32.7trn by the end of the third quarter of 2024.

Read the digital edition of IPE’s latest magazine