The largest 10 European pension funds ended 2020 with a greater allocation to equities and alternative investments, mostly at the expense of fixed income, according to IPE’s Top 1000 Pension Funds 2021, covering €9trn in assets for the leading 1,000 institutions.

In the year that will be remembered for COVID-19, most of the top 10 funds grew either their equity or alternative investments, including real estate, anticipating outperformance of those asset classes as the global economy recovered.

Five out of 10 funds raised their equity allocations, six out of 10 lowered their fixed income allocations and six out of 10 raised their allocation to alternatives.

However, analysis by IPE shows that aggregate equity exposure for the top 10 funds fell from 30% to 28.8% and real estate exposure fell from 9% to 6.1% in 2020. At the same time, the aggregate fixed income exposure grew from 41.4% to 44.05%, driven by PFZW, ATP, Alecta and USS, and the exposure to alternatives grew from 7.7% to 8.7% - an increase driven by ATP and USS, ABP, PFZW, Alecta, PMT, KLP and USS.

Aside from Norway’s Government Pension Fund Global (GPFG), which adopts an index-based strategy investing 72.8% of its assets in equities, the largest equity investors among the top 10 funds are Sweden’s Alecta (40.5%) and Dutch giants PFZW (36.5%) and ABP (33.1%).

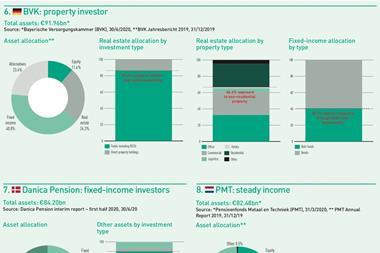

Germany’s Bayerische Versorgungskammer (BVK) has the largest allocation to real estate (24.7%) and alternatives (21.9%), followed by ABP, which had 19.2% of the portfolio invested in alternatives at the end of last year.

However, the large swings in asset prices last year saw Denmark’s largest fund, ATP, shift away from equities and towards fixed income, due to the fund’s risk-parity approach.

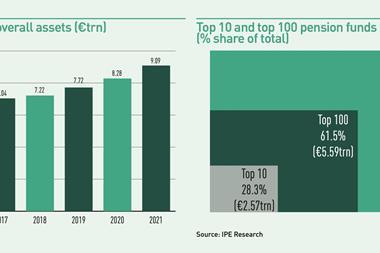

Overall assets in the IPE study increased by 9.8% to reach €9.09trn, with the UK at €2.15trn, followed by the Netherlands at €1.66trn and Norway at €1.28trn, including the Norwegian Government Pension Fund Global.

IPE’s annual research exercise covers a wide spread of pension asset pools, including occupational DB and DC pension schemes as well as national buffer funds and sovereign funds.

German pension assets jumped year-on-year in 2020, slightly reshuffling the latest Germany top-10 ranking.

Total German pension assets amount to €723.6bn compared with €720.8bn in 2020. Occupational pension assets equal to 8.1% of Germany’s GDP on a working population of 43.4m people.

The Bayerische Versorgungskammer (BVK) topped the ranking once again as the largest pension fund in Germany, managing assets of €97.2bn as of December 2020, up from €91.9bn as of June last year.

In France, IPE’s research captured €319.7bn in assets. The data covers a range of entities, such as corporates, unfunded mandatory pension schemes with reserves, and fonds de retraite professionnel supplémentaire (FRPS), which are relatively new IORP-compliant vehicles.

With €17.3bn in assets, the FRPS set up by Allianz, Allianz Retraite, now sits comfortably in the top 10.

A new entry in the Top 1000, it accounts for nearly the entirety of the jump in the AUM recorded for France in the IPE guide. Stay tuned for the October edition of IPE magazine for more about these vehicles.