National Grid UK Pension Scheme (NGUKPS) has awarded an outsourced investment mandate to Russell Investments, IPE understands.

“We can confirm that National Grid UK Pension Scheme and Russell Investments are in the early stages of implementing an outsourced investment solution for the National Grid UK Pension Scheme. We will provide a further update on this partnership in due course,” a Russell spokesperson told IPE.

No further details of the contract have been disclosed at this time, but the mandate is thought to be one of the largest to date in the UK.

As at the end of March 2019 the pension fund had £12.3bn (€14.4bn) in assets under management, according to the group’s latest annual report and accounts.

In June BA Pensions announced a £21.5bn outsourcing move to BlackRock.

In 2015 NGUKPS sold its in-house manager, Aerion Fund Management, to Legal & General Investment Management. It invested 75% of assets with Aerion, with the remainder managed externally.

In conjunction with the decision to outsource, the pension fund set up an in-house investment office to support the trustees with monitoring of external managers, investment strategy and liability management.

The executive office was led by Rob Schreur, previously head of investment for the Philips pension fund in the Netherlands. In 2017 Chris Hogg was appointed chief executive officer, and Schreur left in June this year and is now a board member of the Duchenne Data Foundation.

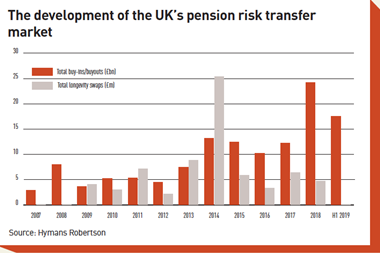

NGUKPS has signed a series of buy-ins in recent years. In October 2019 it announced a £2.8bn deal with Rothesay, which was followed by a £1.6bn deal with Legal & General a month later. In December last year it announced another buy-in with Rothesay, for £800m.