Denmark’s PFA, the country’s largest pension provider, is predicting equity prices will rise for the rest of this year, with the positive trend continuing into 2024 – on the back of interest-rate stability.

Tine Choi Danielsen, chief strategist at the DKK736bn (€98.7bn) pension fund, mainly cited historical market patterns at this point in the year, and past reactions to similar interest-rate scenarios in an upbeat market commentary published yesterday.

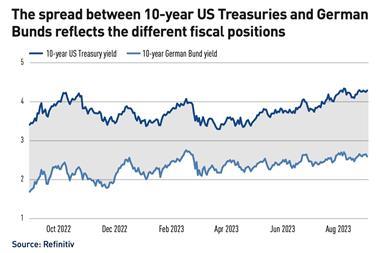

She said: “Central banks in the US and Europe seem reluctant to raise interest rates again.

“Falling inflation and a slowing pace in the economies means that we now expect interest rates to calm down from this point,” said Choi Danielsen.

“Experience shows that benchmark US stocks have risen an average of 12% in the 12 months after the Fed stops raising interest rates,” she said, adding that historically, the months of November and December had also tended to deliver positive returns when there had been a decline in the previous months.

The chief strategist said she had analysed data going back to 1971, and found that out of the 13 times the US central bank had raised rates, in 10 of those periods, the stockmarket index had been at higher levels a year after the Fed put a stop to interest rate hikes.

The Copenhagen-based pension fund still expected the seven largest tech stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – to be the driving force behind 2023’s share price increases, and said the banking and pharma sectors would probably also make a positive contribution.

“At PFA, we have had a good exposure to these companies and sectors up to now, and this has helped to support the return for the benefit of our customers,” Choi Danielsen said.

Read the digital edition of IPE’s latest magazine