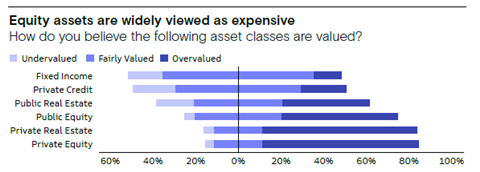

Almost three quarters of institutional investors still find private equity overpriced, according to a global survey by Goldman Sachs Asset Management (GSAM) of 212 investors in alternative assets. Overall, they are still planning to increase their exposure to alternatives, however.

Over 72% of respondents to the GSAM survey, 35% of whom were pension fund executives, believe both private equity and private real estate are currently too expensive.

Real estate is also the only alternative asset class where more investors are net sellers. Some 28% of survey respondents plan to dispose of some of their real estate holdings over the coming year.

“With real estate assets in the process of repricing, and with a more than $2trn wall of maturities over the next three years likely to force more re-valuations, its unsurprising that some LPs [limited partners, e.g. investors] remain cautious about their real estate allocations,” said Jim Garman, partner and global head of real estate investing at GSAM.

“We expect more dislocation ahead as the market adjusts to the new economic reality. This will lead to opportunity for GPs (general partners, e.g. fund managers) who can access and expertly operate assets in areas driven by technological innovation, shifting demographics and sustainability,” Garman added.

Interviewees were more upbeat about private credit, with 59% of LPs considering the asset class fairly valued. As a result, 46% of respondents are planning to increase their allocation. Infrastructure, with 40% planning to increase investments, is also popular.

“LP’s belief that fixed income and credit offer good value is driving interest in private credit. As traditional debt markets retract and capital costs rise, borrowers of all types increasingly seek out innovative and bespoke financing solutions,” said James Reynolds, partner and global co-head of private credit investing at GSAM.

Fundraising struggles

Though GPs indicate that they are planning to continue increasing their exposure to most alternatives segments as they remain underweight to most, 66% of GPs increasingly list fundraising in their top three non-investment challenges.

As a result, they expect longer fundraising timelines than their last raises, although 56% still expect to raise more capital this time.

A major reason for the fundraising struggles of GPs, is LPs saying they plan to make fewer new commitments, reduce the size of these commitments and reduce the number of managers they work with.

While 58% of LPs report zero allocation to co-investments, 59% plan to increase allocations over the next two to three years. Secondaries rank second (48%) for increasing allocations, followed by private credit (46%), venture capital (41%), infrastructure (40%), and opportunistic/distressed (40%).

“They have the highest interest in co-investment opportunities, reflecting their rising desires of LPs across the industry to establish deeper relationships with fewer favoured GPs,” said Francis Idehen, partner and US head of alternative multi-strategy solutions at GSAM.

The latest digital edition of IPE’s magazine is now available