The pension fund for the Swiss canton of Vaud (CPEV) has decided to increase the retirement age to start offering its members new pension plans from January 2027.

With the new plan, the scheme increases the retirement age by two years, while maintaining a defined benefit (DB) approach and a maximum annuity rate of 60% for future retirees, it announced.

The retirement age goes up from 63 years old in the current plan, to 65 years old in the new plan. The increase will be staggered over six years, at the rate of one month per quarter, it added.

The new pension plan foresees a minimum retirement age increasing from 62 to 64 years old for members that had the option to retire at 62 under the old plan, and from 60 to 62 years old for members who could retire at 60 under the old plan.

CPEV will compensate members that have to work longer in the midst of transitioning to the new regime, to maintain a certain annuity rate, it added.

The contribution rate of employees and employers remains untouched at 10% and 15.%, respectively.

The pension scheme has received the green light to kick off the new plan from the supervisory authority in Western Switzerland — Westschweizer BVG- und Stiftungsaufsichtsbehörde – based on the results achieved last year.

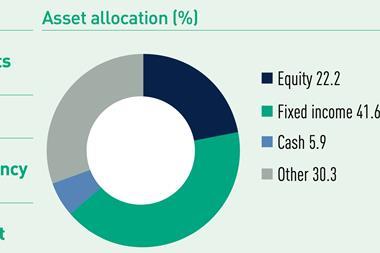

Last year, CPEV returned 5.0%, against -7.5% in 2022, with assets under management totalling CHF14.9bn (€15.7bn), it said in its 2023 financial report.

The scheme’s funding ratio stood at 69.7% last year, slightly up from the required 68.4%. The value of the fluctuation reserve (RFV), intended to cope with returns lower than expected, was 10.4% in 2023, up from 4.4% in 2022, it added.

Earlier this year the scheme submitted its financing plan for 2024 to the regional supervisory authority to change the retirement plan with the help of Aon.

According to the financing plan, the funding ratio will not reach 75% in 2030, but will reach 80% in 2051. The supervisory authority also confirmed that the scheme can continue to be partially funded.

The latest digital edition of IPE’s magazine is now available