While The Pensions Regulator (TPR) encouraged UK pension scheme trustees to use leveraged liability-driven investments (LDI), which involve complex financial instruments, it did not monitor whether its guidance is being followed, an inquiry into the LDI crisis has found.

The report published today by the Work and Pensions Select Committee said that TPR relied on pension scheme trustees as the first line of defence to manage risks, despite its longstanding concerns about governance standards in some schemes, particularly smaller ones which do not benefit from economies of scale.

The committee said that as a regulator, with responsibility for standards of governance in workplace pension schemes, TPR was the second line of defence.

The regulator issued guidance on managing risks of LDI but was not able to monitor whether that was being followed, the report disclosed, adding that it should have focused earlier on the risks of encouraging trustees to use “such complex financial products” and worked with the Department for Work and Pensions (DWP) to consider what further action was needed to mitigate risk.

The committee acknowledged that TPR believed consolidation would improve scheme governance, however it stressed that consolidation required legislation.

The DWP consulted on defined benefit (DB) consolidation back in 2018, but the responses to the consultation have not yet been published. The commmittee’s report said that the DWP should respond to its consultation on DB consolidation no later than the end of October 2023.

It said that the DWP should then work with the regulator as a priority to improve regulation of trustees and standards of governance, as it has stated it intends to.

The committee added: “Given the time it will take to consult on, legislate for, and implement measures to improve governance, DWP should consider whether the use of LDI could be restricted, for example, based on a test related to a trustee boards’ ability to understand and manage the risks involved.”

The committee also said that TPR should work with the Financial Conduct Authority (FCA) to review whether the LDI guidance issued by the FCA in April has been implemented effectively and is providing trustees with the simple mechanism for monitoring LDI that the Financial Planning Committee (FPC) said was needed.

Managing systemic risk

FPC has previously recommended that TPR should specify minimum levels of resilience for the LDI arrangements in which pensions schemes may invest and work with other regulators to ensure these are maintained.

However, the committee’s report found that TPR does not have the data to check whether its guidance is being followed.

It said that DWP and TPR should report back by the end of October 2023 on how they plan to monitor whether LDI resilience is being maintained.

DWP and TPR should also set out a timeline for TPR’s commitment to become a more digitally enabled and data-led organisation, with plans to resource it, the committee added.

DWP and TRP were also told to consult on whether introducing disclosure requirements on pension schemes relating the use of LDI through annual reports or investment statements, would help improve standards of governance.

The committee said: “Collecting better data on LDI is part of what is needed to improve management of systemic risks in future. It will also be essential that DWP and TPR work with other regulators and the Bank of England to analyse its implications.”

Understanding the risks

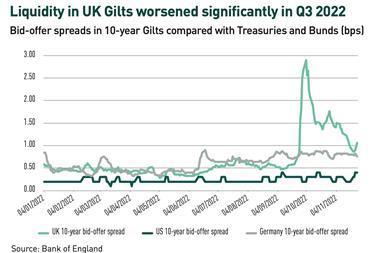

Committee member Nigel Mills told IPE that following the events of last autumn, ”we ended up with a financial system falling down around us”.

He said: “My concern was to undersdant what happened, why, and how we can make sure [it didn’t] happen again.

“It looks like measures were put in place, more liquidity is being held, greater buffers are in place to try and make sure no such thing can happen again. We’ve seen interest rates now go higher than they went last autumn and this should give us some reasurrance.”

However Mills said that the concern is whether pension schemes really “understood what they were doing and what the risks were”.

Joe Dabrowski, deputy director of policy at the Pensions and Lifetime Savings Association, said: “LDI has worked well for many schemes and employers over two decades and has helped defined benefit pensions, in the round, now being much better funded against their liabilities.”

However, he noted, “the proposal for regular reporting to the regulator by pension schemes on their use of LDI is entirely appropriate, and the Committee also agrees with our recommendation to regulate investment consultants”.

Matt Saker, president of the Institute and Faculty of Actuaries (IFoA), said the report captured “the lessons of the crisis” and set out “the remedies in governance and other measures which are already, or soon to be in place, including improved data and guidance”.

He recognised the committee’s challenge that “there is still work to be done”, noted the importance of both the DWP and TPR working together “to ensure consistency between the regulations and the funding code”.

He added: “With the funding code delayed until 2024, there is now an opportunity to look again at the proposals with the committee’s recommendations in mind.”

David Fogarty, professional trustee at Dalriada Trustees, added that “trustee boards need to have sufficient skills and competence to scope what advice is required, to challenge the advice when given, and to ensure the appropriate level of controls are in place to monitor risks”.

“Complex investments such as LDI cannot be allowed to be nodded through on the back of narrow advice,” Fogarty said.

Read the digital edition of IPE’s latest magazine

Join IPE’s Expert Forum in London on Tuesday 4th July to hear from David Fairs and Prof David Blake on the future of LDI – plus a debate on the future of fixed income. Registration and information here