A few months into his second term, US president Donald Trump’s anti-climate agenda has already caused a rift between investors in the US and those elsewhere. While American investors have started to move away from climate investing, their European and Asian counterparts largely stick to their guns.

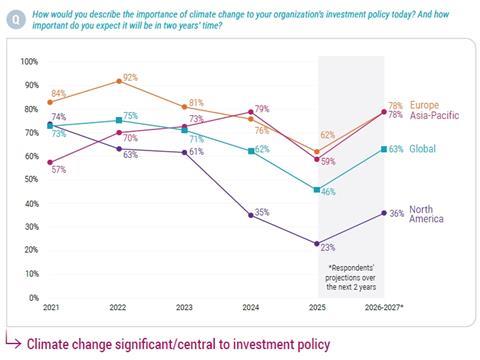

According to the 2025 edition of Robeco’s Global Climate Investing Survey among 300 institutional and wholesale investors, climate investing is now a priority for a minority of investors globally. Only 46% of respondents consider climate investing as “central” to their investment policy, they told the Dutch asset manager.

While appetite for climate investing has come down across the board, this is especially the case for North American investors. Two years ago, 61% of them ranked climate investing as critical to their investment policy. This had dropped spectacularly to just 23% now.

This result is “not surprising,” according to Robeco, “given the growing legal threats to many organisations over ESG and sustainable investing in the US”.

While institutional investors in the country are more likely to stick to some form of climate investing, overall two two-thirds of North American survey respondents do not currently prioritise decarbonisation of their portfolios.

Similarly, only about one in three North American investors currently consider climate mitigation and climate adaptation solutions and technologies as offering attractive risk-adjusted returns.

This picture is radically different for non-American investors. Both in Asia-Pacific and Europe, a clear majority of investors continue to prioritise climate investing, even though support has declined somewhat (see chart).

Against the backdrop of a US government not supportive of climate investing, a clear majority of non-US investors say they will be more likely to look outside the US for investments in areas such as climate solutions, transitioning companies and renewable energy.

An example of this is the Church of England Pensions Board (CEPB), which is actively looking for transition finance investment opportunities in emerging markets.

“If we don’t do it, we are exposing our beneficiaries to additional risk, but equally, us putting £200m into a climate solutions or transition strategy would not hedge that risk effectively,” said Laura Hillis, director, climate and environment, responsible investment, at the pension fund.

“We need to see more investors join us. We want to bring different groups of UK and European asset owners together on investing more in transition companies in emerging markets,” she added.

Non-American investors also believe that momentum for climate investing will recover once US leadership changes. This is in sharp contrast with the beliefs of US investors, who believe overwhelmingly that US government support for climate investing will continue to decrease in favour of a pro-fossil fuel agenda.

Global warming

What investors in all regions have in common, however, is their fading belief that the goal of the Paris Agreement to keep the global temperature rise below two degrees can be accomplished. Some 44% of respondents now think this target is out of reach, while only 31% believe it can still be achieved.

US investors are, perhaps unsurprisingly, most pessimistic. Moreover, almost a quarter of them expect a ‘hot house world’ scenario whereby the global economy continues to increase emissions, with very little, if any, action taken to meet climate goals and to avert physical risks.

“This could be explained by North American investors being personally supportive of climate change action, such as decarbonization, but still feeling frustrated by the current hampered political climate, which has led to a greater sense of negativity,” according to Robeco.

PGGM explores CCS

Dutch pension investor PGGM is exploring a possible investment in carbon capture and storage (CCS), senior advisor responsible investment Maurits Heldring told Robeco.

Such an investment would be part of a new €1bn climate energy transition mandate.

According to Heldring, it’s “not easy” to allocate this money outside solutions that are already popular, such as renewable energy or electric vehicles.

“But that is not where we want to spend it. We are also looking at technologies like battery storage, which we see as an attractive technology to help solve grid congestion,” he added.

The latest digital edition of IPE’s magazine is now available