Pension System – Page 116

-

News

NewsAP Funds need same definition of illiquid assets, McKinsey tells Sweden

Swedish pensions buffer funds cut fossils exposure by between 51% and 100% in five years

-

News

UK roundup: Lancashire LGPS launches 2021-2024 strategic plan

Plus: London borough scheme hires Aon as consultant

-

Opinion Pieces

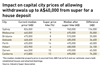

Opinion PiecesLetter from Australia: Should super savings fund homes?

A post-COVID-19 housing boom has made the future of Australia’s A$3trn (€2trn) superannuation savings pool a hot topic.

-

Country Report

Country ReportAustria: Sustainable growth remains elusive

Austrian providers are calling for solutions to make occupational pensions more appealing in light of demographic pressures and COVID-19 fallout

-

Opinion Pieces

Opinion PiecesLetter from US: Pension bonds raise concerns

The resurgence of interest in pension obligation bonds (POBs) is one of the effects of the pandemic on the US pension funds industry. Indeed in 2020 POB issuance reached its highest level in a decade, exceeding $6bn (€5bn), according to Municipal Market Analytics (MMA), an independent research firm focusing on the US municipal bonds.

-

Country Report

Country ReportPension Risk Management: Dealing with a challenging year

German pension investors are evolving to adapt to new realities in terms of assets and liabilities

-

Country Report

Politics and investment: Germany looks to Sweden

Politicians are looking abroad for ways to boost equity investment in long-term savings

-

Interviews

InterviewsHow we run our money: Sampension

Henrik Olejasz Larsen, CIO at Denmark’s Sampension, talks to Carlo Svaluto Moreolo about the fund’s bias towards value equities and its diversification strategy

-

Country Report

Country ReportSocial partner pensions: An overlooked model

Just one new DC-type arrangement has emerged in Germany in the past three years. More could follow, bringing a boost to Germany’s neglected second pillar

-

News

German finance ministry plans interest rate cuts to pension products

The ministry is convinced the adjustment will contribute to the long-term stability of life insurers

-

News

NewsIlmarinen fails to reach its five-year goal of Paris alignment

Finnish pension insurer boasts it was the most solvent pension insurer last year

-

News

NewsPension tax nets Danish state twice as much as oil, says IPD

Lobby group says pension return tax produced €6.5bn in revenues for the government last year

-

News

DACH pension funds prepare for potential inflation hike

SBB expects inflation to rise over the next one to two years but to a limited extent, while interest rates will level off at a slightly higher level than today

-

News

DAX firms top outlook with €9.9bn returns on pension assets

Pension liabilities and pension assets of DAX firms decreased last year by 1.8% and 3.9% to €409bn and €266bn, respectively

-

News

NewsAMF becomes biggest pensions firm to seek Swedish IORP II status

Move ‘safeguards opportunities to continue investing wisely and long-term’, says Swedish pension provider

-

News

PEPP survey launched following EU Parliament approval

The EC’s Delegated Regulation on PEPP becomes applicable from 22 March 2022

-

News

NewsACCESS pool plans illiquid assets consultant appointment

The appointed firm will assist the asset owner with the implementation of various illiquid asset structures

-

News

EIOPA decides Bernardino successor shortlist

Candidates are from the Prudential Regulation Authority in the UK, De Nederlandsche Bank, and Athora, a German life insurer

-

News

DWP consults on pension schemes’ approach to ‘social factors’

Pensions minister turns his attention from climate change to the ‘S’ in ESG

-

News

Three in four UK DB schemes could turn to contingent funding

Consultancy LCP says several factors will account for big rise in popularity