All Pensions Briefing articles

-

Features

FeaturesUK court cases spell trouble for passive shareholders

In the Allianz vs Barclays case, passive investors have been denied damages related to investments in companies releasing misleading information

-

Features

FeaturesDutch suggestions for fine-tuning pension funds’ climate stress tests

Five Dutch IORPs supplemented EIOPA’s 2022 stress test, the first to include climate scenarios, with their own more granular approach

-

Special Report

Special ReportRegulation: EC continues sustainable investment regulation drive

The state of play for EU sustainable finance regulation

-

Special Report

Special ReportRegulation: IPE’s guide to pensions regulation in six key European countries

IPE’s guide to pensions regulation in six key European countries. Gail Moss reports

-

Special Report

Special ReportRegulation: EIOPA takes stock of IORP II

Sustainability requirements in focus as EIOPA admits cross-border ‘failure’

-

Features

FeaturesDefining the precise scale advantages for DB pension funds

Most people working in the institutional asset management space have an intuitive understanding that the size of the institution, measured by total assets under management (AUM), has an impact on performance – that bigger funds tend to perform slightly better. On the other hand, there are plenty of stories of successful hedge funds that got too large and lost their way, unable to continue delivering on past success due to their size. So which is it? Do larger institutional investors outperform their smaller kin, or is AUM the proverbial millstone in terms of performance?

-

Features

FeaturesBriefing: Unfinished business on IORP II

Almost three years on from the effective date for the implementation of IORP II, the directive is still being worked on, amended and adapted by Europe’s regulators. What will 2022 bring for the regulation of the EU’s pension funds?

-

Features

FeaturesBriefing: Long-term investing: it’s up to the pension board

A practical framework for pension fund trustees looking to implement long-term investment approaches

-

News

Pensions Briefing: Incorporating ESG factors in pension investment activity

A look at IOPS supervisory guidance on the integration of ESG factors in the investment and risk management of pension funds

-

Features

FeaturesDutch hedging strategies: Dynamic approaches in favour

Levels of interest rate hedging cover used by Dutch industry-wide pension funds vary widely, according to figures published late last year by pensions supervisor De Nederlandsche Bank (DNB).

-

Features

FeaturesPensions depositaries: IORP II’s new consolidation option

European pensions legislation raises the possibility of a new kind of consolidation vehicle that could also accommodate large Dutch mandatory industry-wide pension funds

-

Features

FeaturesHow to improve EIOPA’s stress test

EIOPA’s 2019 stress tests already included substantial improvements, but the cash flow analysis could be improved further

-

Features

FeaturesiTDFs: A formula to end retirement blues?

All over the world, the financial industry is grappling with the ‘ideal’ post retirement investment strategy and with how best to pay out income in retirement. There is an arms race and the question is the following: who will win the retirement agenda?

-

Features

FeaturesCross-border pensions: Barriers to entry

The experience of Bosch shows that a better framework is required for cross-border pensions

-

Features

FeaturesForeign pension funds set for tax refunds on UK property income

A recent ruling by the UK Tax Tribunal decided that the imposition of UK income tax on the property income of a German pension scheme was unlawful under EU law

-

Features

PEPP: no straightforward route

Some entities will not be eligible to offer PEPP products in Bulgaria, which looks like a recipe for market confusion

-

Features

Annuity innovation: A new decumulation solution

With the decline of DB pension funds, individuals are seeking alternatives for longevity protection

-

Features

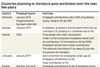

FeaturesAuto-enrolment grows globally

A growing number of countries are planning to reduce the strain placed on public finances of providing pensions to ever more retirees by encouraging individuals to make more adequate provision for their own retirement

-

Features

Collective DC in the Netherlands

How Dutch collective defined contribution schemes came about and how they differ from other schemes