Pensions in Italy Report

In-depth reporting and analysis of the pensions sector in Italy for our pension fund and asset management readers from IPE’s award-winning journalists.

-

Country Report

Country ReportItaly country report 2025: Pension funds step out of their comfort zone, diversify portfolios

While maintaining a domestic bias, Italian institutions are venturing into new asset classes to further diversify their portfolios

-

Country Report

Country ReportCase study: Italian notaries pension fund CNN advances into private markets

Fund models strategy around macro-trends

-

Country Report

Country ReportCase study: Italian pension fund Enpam creates two-part investment portfolio

Doctors’ fund is repackaging assets into cash flow-matching and return-seeking parcels

-

Country Report

Country ReportCasse di previdenza put under the spotlight

First-pillar pension funds have faced parliamentary scrutiny over their investments, returns and relationships with advisers

-

Country Report

Country ReportItalian pension funds consolidation grinds to a halt

Mergers between pension funds have been too few to have an impact on the Italian pension industry

-

News

NewsItaly changes early retirement option

The new rule allows a merger of first and second-pillar contributions

-

Country Report

Country ReportItaly Country Report 2024: How local pensions could support the economy

The Italian pension industry and policymakers are discussing ways to channel more pension investment towards the country’s business sector

-

Country Report

Country ReportItalian pension funds fine-tune asset allocation

Growing appetite for private market investments, amid shifting equity and bond portfolios, are keeping Italian pension funds busy

-

Country Report

Country ReportCDC pension fund benefits from a steady stream of young members

The Cassa Dottori Commercialisti (CDC) is one of the most sustainable casse di previdenza, the Italian privatised first-pillar funds for professionals, thanks to prudent asset allocation and the CDC’s policy to attract young Italians to the chartered accountancy profession.

-

Country Report

Country ReportPrevimoda fine tunes for better results

In 2023, Previmoda, the pension fund for the fashion and textile sector, rejigged the strategic asset allocation of its sub-funds Smeraldo Bilanciato, which has a higher exposure to fixed-income, and the equity-focused Rubino Azionario.

-

Country Report

Country ReportENPAM looks to preserve cash flow

In February 2024, the board of ENPAM, the first-pillar pension fund for doctors and dentists, approved plans for the fund to transition to an asset liability management (ALM) model that will focus on liability-driven investment (LDI).

-

Country Report

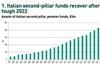

Country ReportSlow growth for Italy's second-pillar pensions

Despite the urgency of increasing second-pillar coverage, policymakers continue to focus reform efforts on public pensions

-

Country Report

Country ReportCountry report – Pensions in Italy (July/August 2023)

Italian second-pillar occupational pension funds continue on their path to diversification. Owing to the higher yields on offer in traditional fixed income markets, allocations to private markets may slow down temporarily, but funds have made long-term strategic commitments. A variety of industry initiatives is facilitating investment in private equity, private debt and infrastructure. Meanwhile, some pension funds are consolidating their private markets portfolios.

-

Country Report

Country ReportItaly: Private markets allocations at a crossroads

Italian pensions funds are showing renewed interest in fixed income, as investment in private markets slows down – but long-term commitments are still in place

-

Country Report

Country ReportItaly: Byblos consolidates private markets portfolio

The industry-wide fund has opted for a single external multi-asset mandate for private equity, private debt and infrastructure

-

Country Report

Country ReportItaly: Government plans to draw in capital for domestic investment

The right-wing government is moving forward with plans to create a €1bn fund, amid criticism and lukewarm investor support

-

Country Report

Country ReportItaly: Casse di Previdenza roll with the punches

Italian industry-wide pension funds fail to attract new members, with potentially serious long-term consequences

-

Country Report

Country ReportItaly: Pension funds face SFDR test

A significant number of pension funds have classified their portfolios under the EU’s flagship sustainability disclosure regulation

-

Country Report

Country ReportItaly: Pension investors raise their sustainability game

Pension funds and other institutions are making greater use of engagement and voting as they pursue their ESG goals

-

Country Report

Country ReportCountry Report – Pensions in Italy (July/August 2022)

Italy’s pension industry continues to develop, albeit at a slow pace. Italian pension funds are adapting their strategies to the volatile and uncertain market regime, by purchasing inflation-linked assets and by taking advantage of potentially higher yields on domestic government bonds. However, as our lead article highlights, they are generally staying true to their long-term diversification strategies, which consist of gradually allocating to alternatives including private equity, private debt and infrastructure. Some have bought shares in the Bank of Italy, a private equity-like investment.