Pensions in Netherlands Report – Page 3

-

Country Report

Country ReportNetherlands: Is Dutch pensions reform EU-proof?

There are reasons to think that the new Dutch pension contract could fall foul of European law

-

Country Report

Country ReportNetherlands: New paths

The new Dutch pension agreement could unleash a new wave of thinking around risk taking and portfolio construction, with strong similarities to the way some Nordic schemes are run

-

Country Report

Country ReportNetherlands: View from the top

Gerard van Olphen, chair of the executive board at APG, discussed the agreement with Liam Kennedy at IPE’s Summer Pension Congress

-

Country Report

Country ReportNetherlands: A sector holding its collective breath

A tripartite steering group involving experts, stakeholders and government is trying to come up with a new concept for pension plans

-

Country Report

Country ReportNetherlands: Funds delay trouble

Crucial decisions loom for Dutch pension funds as low rates bite hard

-

Country Report

Country ReportNetherlands: Still searching for yields

Dutch pension funds are looking towards illiquid assets as they search for returns in the challenging low-interest-rate environment

-

Country Report

State pension age: Another hurdle for pensions reform

Unions mistrust politicians following ‘many broken promises’

-

Country Report

Country ReportAlmost solved...

Nicole Beuken, executive director of ABP, the largest pension fund in the Netherlands

-

Country Report

Country ReportKey Dynamics: A market overview

Alternatives, ESG adoption and further fund consolidation are the key trends highlighted by INDEFI

-

Country Report

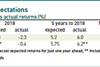

Country ReportInvestment: The limits of expectations

How are Dutch funds doing against their long-term targets?

-

Country Report

Fiduciary responsibility: A question of legality

Managers remain puzzled on meaning of legal amendment

-

Country Report

General pension funds: A market stirred but not shaken

General pension funds nearly doubled their AUM last year, to €10bn. However, one of the six commercial players has already closed and another will probably leave the market

-

Country Report

Multi-sector magnet

Since 2011, PGB has almost doubled its number of participants to 235,700 from pension funds from a diverse range of sectors

-

Country Report

Country ReportThe Netherlands: Pensions reform poses IT puzzle

Dutch pension managers will need to significantly adjust their IT systems if a pensions contract with individual accrual becomes the key element in a new Dutch pensions system

-

Country Report

Asset allocation: Steadying the ship

Better funding positions offer Dutch pension funds a chance to increase diversification

-

Country Report

Country ReportDutch pensions: IT is a bottleneck

Antiquated IT systems stand in the way of an overhaul of Dutch pensions

-

Country Report

New system: A spring deadline

Despite appearances to the contrary, a compromise on a future retirement system may be close

-

Country Report

Fiduciary management: Foreign fiduciaries struggle

Pension funds’ changing requirements are having a profound effect on the market for fiduciary management