Pensions in United Kingdom Report

In-depth reporting and analysis of the pensions sector in the United Kingdom for our pension fund and asset management readers from IPE’s award-winning journalists.

-

Country Report

Country ReportUK country report 2025: Defined benefit pension schemes face surplus unlock dilemma

Defined benefit pension schemes could face some tough decisions on how to deal with surpluses if planned legislative changes to ease access come into effect

-

Country Report

Country ReportRailpen CEO on board for member focus

New CEO’s sights are trained on member outcomes as the organisation looks ahead to a simpler rail sector under public ownership

-

Country Report

Country ReportUK government pushes for further consolidation of Local Government Pension Scheme pools

The Labour government has laid down the gauntlet for the existing eight pools managing almost £400bn of local government pension assets to consolidate further

-

Country Report

Country ReportVirtue or folly? UK pension funds eye domestic market investments

Canada, the Netherlands, Scandinavia and Australia all have considerable pension assets invested in their local economies – is it time for the UK to follow suit?

-

Country Report

Country ReportInnovation reshapes the UK pension risk transfer market

Spurred on by improved DB scheme funding, the market has seen both new entrants and returnees

-

News

NewsPhoenix Group and Schroders team up to launch private markets firm

Future Growth Capital is first private market investment manager to be established in the UK to promote objectives of Mansion House Compact

-

Country Report

Country ReportUK Country Report 2024: Is buyout still the gold standard for pension funds?

Improved funding positions mean more DB schemes are considering run-on rather than off-loading their liabilities

-

Country Report

Country ReportMercer’s upbeat vision for UK pension funds and their investment advisers

James Lewis, UK CIO at Mercer, is optimistic about the future of the UK’s DB and DC industries

-

Country Report

Country ReportHow consolidation might affect the UK’s local government pension sector

There is political consensus on the need for local government pension schemes to merge, but the question of in-house asset management is less straightforward

-

Country Report

Country ReportBridging the stewardship gap between companies and investors

Findings of research into how well corporates and investors communicate

-

Country Report

Country ReportSolvency UK: tweaks likely to bring only marginal gains

The UK’s reforms of the Solvency II framework are unlikely to be enough to usher in a big wave of investment in domestic productive assets by insurers

-

Country Report

Country ReportProgress report on the UK’s Mansion House capital market reforms

Details of potential changes to the UK’s pension landscape have been thin on the ground

-

Country Report

Country ReportCountry Report – Pensions in UK (May 2023)

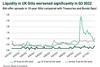

UK pensions are at a crucial juncture. The UK Parliament’s inquiry into the LDI crisis of September 2022 shed some light on its causes, but the debate on the role of LDI is alive and well. Meanwhile, regulators including The Pensions Regulator and the Financial Conduct Authority have advised pension schemes on how to make LDI strategies more resilient to shocks.

-

Country Report

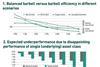

UK: One way for DC schemes to access private markets

There is much debate about mark-to-model valuation methodologies and whether a material economic downturn will cause these to catch up with public market price falls, but the history books will show that portfolios with allocations to private markets were more robust than those with none in 2022 – the worst year on record for traditional balanced portfolios.

-

Country Report

Country ReportUK: Can the country turn a flawed investment ecosytem around?

Decades of complex legislation has fuelled many unanticipated consequences, which has seen pension funds invest less in riskier listed equities and illiquid assets

-

Country Report

Country ReportUK: to barbell or not to barbell?

In the new world of lower LDI leverage, trustees must choose between maintaining hedging or diversification

-

Country Report

Country ReportUK: Beware the unintended consequences of the DB funding code

Laura McLaren highlights the unintended consequences of TPR’s proposed code, and what can be done to mitigate the risks

-

Country Report

Country ReportUK: The case for pooling

Successful pooled schemes such as Border to Coast should be open to other clients because they are good at what they do

-

Country Report

Country ReportUK: DC investment won't be a panacea for tech and science

The UK government’s March Budget contained plans to boost investment in high-growth industries such as digital, life sciences and advanced manufacturing, so they can start, scale up and remain in the UK.

-

Country Report

Country ReportUK: A review of the LDI debacle

The UK Parliamentary inquiry into the LDI crisis has shed light on its causes, but the debate over the lessons learned for the UK DB industry is far from over