Private Debt – Page 3

-

News

NewsEnpam targets innovative firms with €190m investment

The Italian pension fund for doctors plans to keep its private markets allocation stable, targeting 12-13% returns in private equity and 7-8% in private debt

-

Asset Class Reports

Asset Class ReportsIs it time for private credit to step up on investing in artificial intelligence?

Besides digital and power infrastructure, investors are beginning to shift their focus to other areas of the burgeoning AI market

-

Asset Class Reports

Asset Class ReportsConsolidation in the private credit space points to a maturing phase

Recent M&A activity in private credit follows hot on the heels of a decade-long boom. Is there more to come?

-

Opinion Pieces

Opinion PiecesThe evergreen funds evolution in private credit investments

The market turmoil of 2022 taught pension funds a fundamental lesson about balancing long-term objectives with short-term events.

-

Asset Class Reports

Asset Class ReportsPrivate credit turns evergreen as funds grow in number

As managers compete for scale and expand their footprint, the role of evergreen private credit funds is expected to grow

-

Asset Class Reports

Asset Class ReportsLP perspectives: European pension funds on private credit strategies

Two European pension funds detail how they are tapping into the private credit market at a time of exponential growth and heightened volatility

-

Asset Class Reports

Asset Class ReportsViews from the top: Leading general partners on the evolution of private credit

We polled leading GPs on the evolution of private credit. They detect the growing strength of institutional investor interest but as competition increases and the market comes under greater scrutiny, could increased regulation be on the way?

-

Interviews

InterviewsInterview: M&G Investments’s big bet on private markets

CEO Joseph Pinto wants to grow largest private markets business in Europe

-

News

NewsM&G snaps up majority stake in European private-credit business

P Capital Partners will become part of M&G Investments’ £73bn (€87bn) private markets business

-

Analysis

AnalysisAsian emerging markets on the rise

Investors are taking note of investment opportunities in Asia in a variety of different ways, as new research shows

-

News

NewsAPG and Rabobank invest €800m in new impact loans

The investment has been made through Colesco Capital, a new Rabobank-owned investment platform with a focus on sustainable corporate loans

-

News

NewsVBL to boost private equity and private debt investments

New allocations will be financed through new premiums and a mix of public equities, gold and cash, says CIO Michael Leinwand

-

News

NewsATP disappointed as Better Energy restructures

Citing ‘perfect storm of negative market conditions’, Danish renewable-energy firm enters restructuring to rebuild capital base and stabilise the business

-

News

NewsPension funds seek private equity managers with ability to add long-term value

Emphasis is shifting from quantity to quality in private markets as investors seek GPs with superior skills and the ability to add value above and beyond financial engineering

-

News

NewsIPE Conference: Private debt said to make overall economy more resilient

From a system risk point of view, private debt funds are much less risky than bank lending, Tilburg University professor argues

-

Analysis

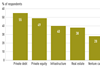

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

News

NewsAviva Investors launches third UK LTAF with addition of private debt fund

New fund gets £750m cash injection from Aviva’s Future Focus default pensions solution

-

News

NewsHSBC Asset Management targets venture debt offering

Former Silicon Valley chief credit officer has been tasked to bring new product to market

-

News

NewsItaly’s pension fund for notaries ponders first move into private debt

Cassa Nazionale del Notariato currently has 3-4% invested in private equity and infrastructure funds