All Private Equity articles – Page 14

-

News

Norway’s new northern fund to be separate from sovereign fund, panel advises

Working titles for proposed investment unit are ‘Government New Northern Fund’ and ‘Government Pension Fund Arctic’

-

News

NewsNet Zero Asset Owners lay out expectations for private markets managers

The group is asking private markets managers to disclose their scope 1 and 2 financed emissions for the 2023 financial year

-

News

To rebalance or not? Dutch pension funds face dilemma as illiquids exceed limits

Bpf Bouw will sell close to €3bn in hedge fund investments and is also reconsidering its private equity and real estate holdings

-

News

Private equity investments in CEE poised for strong growth

CEE countries show consistent outperformance, compared to Western Europe, according to Bain research

-

News

Private equity continuation funds to see ‘record high’ in Q1 2023

Private equity funds are responding to the record gap in expectations between sellers and buyers by launching continuation funds

-

News

NewsShift to unit-link pensions threat to Swedish tech start-up success, says AMF

AMF’s CIO responds to McKinsey study warning of the risks associated with occupational pension capital being increasingly driven out of traditional insurance

-

News

Policy Exchange calls for Solvency II reform to tackle policy, regulatory challenges

Report suggested UK is sitting on large pools of capital and could do more to invest in growth businesses, infrastructure and other productive assets in the UK

-

News

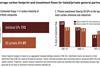

IPE survey: private equity managers expect stable fundraising, transaction volumes

Given the current valuation levels, 64% of managers said they expected transaction volumes to be stable over the next two years

-

Features

Features17Capital’s Pierre-Antoine de Selancy: Navigating NAV lending

Pierre-Antoine de Selancy has just left a meeting with his company’s new majority shareholder, Oaktree, and is running a little late. His days are busy. De Selancy is founder and managing partner of 17Capital, a London-based boutique specialised in providing NAV finance to private equity managers.

-

Asset Class Reports

Private markets: Pension funds review private equity as allocations hit targets

Lower equity and fixed income values see pension funds off-load their exposure to illiquid assets

-

Special Report

Special ReportESG: Dirty asset divestment

There is growing focus on public companies that are under pressure to sell high-carbon assets to unlisted companies or private equity

-

Special Report

Special ReportESG: Private equity faces disclosure scrutiny

The CSRD will see a fourfold increase the number of corporates subject to sustainability reporting requirements, placing increased demands on private equity firms

-

Special Report

Special ReportESG: Leading viewpoint - private equity GPs are stepping up to the plate

Private equity firms can be a powerhouse for responsible investment

-

Asset Class Reports

Asset Class ReportsPrivate markets report

Our report looks at the impact of economic uncertainty on private debt strategies and on venture capital. We focus on the rising role of pension funds in the private equity secondaries market. We explain in detail what ‘tokenisation’ of private assets is and how it could change this market for institutional investors.

-

News

Alecta follows peer AMF into battery unicorn Polarium with €87m

Swedish pensions giant’s equity chief predicts huge long-term demand for batteries as part of the renewables transition

-

News

NewsPrivate equity, mortgages enter net-zero alliance’s protocol in new draft

UN’s investor alliance expands guidance on treatment of sovereign debt in draft of third version of target-setting protocol

-

Opinion Pieces

Opinion PiecesViewpoint: Irredeemably irrational – why using IRR to benchmark and pick funds makes no sense

With the continuing proliferation of managers, strategies and funds, wouldn’t it be wonderful if there was one simple metric that could help determine which to back (and which to avoid)? The good news: there is. The bad news: you’re probably not using it.

-

News

NewsDutch pension funds’ private equity investments exceed €100bn

The rise comes as funds’ public equity investments have dropped to a multi-year low of €405bn

-

News

Publica in talks with large pension funds for co-investments in infrastructure

Publica’s board decided to reduce its fixed income allocation as part of its new strategy

-

News

Pension funds ratchet up search for private market alternatives

At the same time new searches for listed equity and bond managers fell to new lows, with the exception of EM