All Private Equity articles – Page 15

-

Features

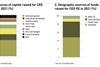

FeaturesCEE private equity: in search of capital

War in Ukraine is just one factor deterring investment in private equity and growth capital in Central and Eastern Europe

-

News

NewsPFA rapped by Danish FSA over alternatives risks

Danish commercial pensions heavyweight told to correct strategic approach to alternative investments

-

News

AMF invests €35m in privately-held Swedish fossil-free steel company

Firm aims to produce 5m tons fossil-free steel a year from 2030 says Swedish pensions giant

-

News

Pension funds expected to become largest sellers on private equity secondary market in H2

Interim sales of private equity investments worldwide have grown steadily from $40bn in 2015 to $132bn in 2021, says Bain Capital

-

News

Schroders identifies persistence in private equity returns [updated]

Research by Schroders Capital finds that past performance could be more instructive for some parts of the private equity market than others

-

News

NewsGerman government ditches plan to deploy pension capital for VC funds

Instead, start-up strategy envisions opening up the VC market to institutional investors through a German Growth Fund

-

News

Poll shows 10 percentage-point rise in ESG use by alternatives investors over 3 years

Two thirds of European investors in private equity, infrastructure, now have climate policies compared to less that a quarter of their US peers, new survey shows

-

News

NEST appoints HarbourVest as part of £1.5bn private equity push

New mandate will play an important role in helping NEST invest around 5% of its portfolio in private equity

-

News

NewsBorder to Coast commits final investments in first £5.7bn private markets programme

In total, the programme invested into 61 funds and made three co-investments

-

News

Danish FSA tells Industriens Pension to consider adding more PE staff

Watchdog hands out official orders to correct private equity management procedures, as part of wider focus on the way pension funds handle the asset class

-

News

PenSam told to tighten up procedures around private equity valuations

Danish FSA hands out official orders to add paperwork on performance monitoring, amid wider regulatory focus on private equity

-

News

ATP, AMF, AP funds and Folksam back Northvolt in $1.1bn financing

Large Nordic pension funds up their investments in Swedish battery maker as it seeks to boost production

-

Country Report

Country ReportCountry Report – Pensions in Italy (July/August 2022)

Italy’s pension industry continues to develop, albeit at a slow pace. Italian pension funds are adapting their strategies to the volatile and uncertain market regime, by purchasing inflation-linked assets and by taking advantage of potentially higher yields on domestic government bonds. However, as our lead article highlights, they are generally staying true to their long-term diversification strategies, which consist of gradually allocating to alternatives including private equity, private debt and infrastructure. Some have bought shares in the Bank of Italy, a private equity-like investment.

-

Country Report

Country ReportItaly: Pension funds adapt to a new regime

Inflation, higher interest rates and geopolitical tensions are leading Italian pension funds to recalibrate their investment strategies

-

Opinion Pieces

Opinion PiecesUS: A cautious approach on private assets in DC plans

Will 2022 be the year when private equity is finally incorporated in US defined contribution (DC) plan line-ups? Possibly, following the Department of Labor’s (DoL’s) clarification of its position in a letter last December. But it will be a very slow process, according to industry experts.

-

Features

Features‘Painful’ private equity fees are hard to avoid

The Netherlands’ €551bn ($576bn) civil service scheme ABP paid a record €2.8bn in performance fees to private equity managers in 2021, prompting the fund’s president Harmen van Wijnen to announce an external investigation to assess ABP’s rising asset management costs. The €277.5bn healthcare scheme PFZW paid €1.26bn in performance fees to private equity last year, accounting for two thirds of total asset management costs.

-

News

ATP’s new domestic investment unit stays true to goal after first deal

Danish statutory pensions giant invests DKK three-digit million sum in sports tech Veo

-

News

NewsPrivate equity returns at near-record 16%

Coller Capital publishes 35th bi-annual global private equity survey

-

News

NewsAP7 one step closer to adding illiquids as proposal moves ahead

Government submits legal advice referral for changes to AP7’s investment rules

-

News

NewsGerman government plans to channel pension assets for VC investments

Also considering setting up a facility to finance young innovative companies that previously had no access to venture capital funds