All Private Equity articles – Page 5

-

News

NewsPensionDanmark to ramp up equities after 17% stocks gain in 2024

Danish pension fund to increase the equity proportion particularly for younger scheme members, and postpone risk reduction starting point by five years to age 50

-

News

NewsP+ taken to task by Danish FSA over private equity risk measurement

Financial watchdog criticises pension fund for failing to document appropriateness of data source behind model to estimate PE risk premium

-

News

NewsATP disappointed as Better Energy restructures

Citing ‘perfect storm of negative market conditions’, Danish renewable-energy firm enters restructuring to rebuild capital base and stabilise the business

-

News

NewsATP admits DKK2.3bn investment in Northvolt now worth almost zero

Danish statutory pensions giant’s CEO declines to rule out investing more in stricken battery Swedish firm

-

News

NewsCandriam enters European private equity market in strategic partnership

Partnership positions Andera to expand its client base and further develop its private capital strategies across Europe and globally

-

News

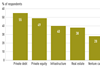

NewsPension funds seek private equity managers with ability to add long-term value

Emphasis is shifting from quantity to quality in private markets as investors seek GPs with superior skills and the ability to add value above and beyond financial engineering

-

News

NewsMonte dei Paschi scheme seeks asset managers for DB sub-fund, private equity

The pension fund is looking for an asset manager to invest €70-80m in private equity and another for €80m to run its DB sub-fund

-

Country Report

Country ReportDanish pension funds split over venture capital opportunities

PensionDanmark is backing early-stage venture capital investments but its peers are shying away from VC

-

Analysis

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Interviews

InterviewsLeapFrog eyes global impact investment opportunities

Impact investing was once a niche concept. “We were seen as the weird people in the corner of the room,” recalls Andy Kuper, the South African founder and CEO of LeapFrog Investments

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

News

NewsPrivate equity, VC ESG reporting template gets update for early-stage

Update ‘aligns with the requirements of major European LPs’, according to KfW Capital

-

News

NewsNordic pension funds protect interests as Northvolt seeks bankruptcy protection

CEO exit ‘not entirely unusual’ given Swedish battery firm’s new phase, says Folksam

-

News

NewsFidelity International to integrate private markets assets into default investment strategy

The circa 15% allocation by Fidelity’s FutureWise fund will be the first into its recently approved Long-Term Asset Fund

-

News

NewsATP’s returns leap in Q3 despite private equity write-downs

Danish pensions giant posts 9.7% gain on investment portfolio in January-September despite massive private equity wipeout

-

Country Report

Country ReportLower interest rates see Swiss pension funds adjust asset allocations

Lower rates are nudging Swiss pension funds to rethink their approach to fixed income and private markets

-

Asset Class Reports

Asset Class ReportsInvestor body aims to fill reporting gap

ILPA issues reporting guidance and templates after US court overturns SEC’s private funds rule

-

Asset Class Reports

Asset Class ReportsValuations for AI-related firms are starting to heat up

There are concerns that the market for acquiring artificial intelligence-related companies is showing signs of overheating

-

Interviews

InterviewsPrivate equity remains a key building block for pension schemes

While allocations vary, pension funds value solid returns and private equity’s role as a diversifier. Funds use PE to gain both domestic and international exposure.

-

Asset Class Reports

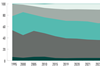

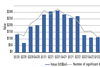

Asset Class ReportsPrivate equity industry starts to show signs of recovery

Private equity has a bounce in its step once again, but it could be years before the industry recovers fully