All private markets articles – Page 5

-

News

NewsTech stocks, private markets bump up Previmoda’s returns

The scheme’s sub-funds ‘Smeraldo Bilanciato’, ‘Rubino Azionario’ and ‘Garantito’ have seen returns of 6.05%, 8.84% and 4.13%, respectively

-

News

NewsABP to up infra investments in new pension system

In its investment strategy for the new DC pension system, the Dutch civil service scheme will increase the share of private market investments from 20% to 30%

-

Opinion Pieces

Opinion PiecesViewpoint: The new market reality requires a total portfolio approach

In this new era of lower returns with higher risk, investors must rethink how they balance risk, liquidity and returns with greater discernment and due diligence

-

News

NewsNEST takes 10% stake in Australia’s IFM with £5bn private markets commitment

UK’s NEST joins 16 Aussie super funds, taking 10% ownership stake in IFM’s holding company

-

News

NewsGenerali Italia boosts investments in domestic private assets to €4.7bn

Increasing investments in the domestic economy are linked to the growth of the supplementary pension sector

-

News

NewsVBL to boost private equity and private debt investments

New allocations will be financed through new premiums and a mix of public equities, gold and cash, says CIO Michael Leinwand

-

News

NewsMandating minimum size for DC schemes won’t push for UK investment

Consolidating DC schemes will take a long time, cause massive cost and disruption and may still fail to deliver government’s objectives, says LCP

-

News

NewsPE exits ‘bode well’ for DC pensions market and private market investment

UK government aims to increase pension fund investment in UK private markets

-

News

NewsL&G default contract-based DC fund to target 15% allocation to private markets

L&G claims new funds have potential to deliver value for money and better outcomes in retirement

-

News

NewsPension funds seek private equity managers with ability to add long-term value

Emphasis is shifting from quantity to quality in private markets as investors seek GPs with superior skills and the ability to add value above and beyond financial engineering

-

Analysis

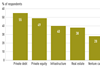

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

News

NewsGeopolitical conflict tops concerns list for pension funds

To hedge against this risk, funds want to further diversify their portfolios, for example by increasing investments in private assets

-

News

NewsAegon, NatWest Cushon commit to help with British Growth Partnership launch

Chancellor has previously tasked British Business Bank with establishing the British Growth Partnership

-

Country Report

Country ReportSpanish country report 2024: Pension funds eye a new rate environment

Buoyed by strong returns, pension funds have been lengthening the duration in their fixed-income portfolios

-

Opinion Pieces

Opinion PiecesViewpoint: Pension funds must be at the centre of the UK investment debate

Long-term net zero delivery success demands a pro-investment, co-investment mindset from all sides

-

News

NewsItalian pension funds ask for tax concessions to invest in real economy

It is necessary to simplify legislation to effectively enforce and reap the benefits of tax exemptions, says Assofondipensione’s Giovanni Maggi

-

Analysis

AnalysisViewpoint: Opportunities for investing in UK economic growth is aligned with trustee’s fiduciary duty

NEST sees no conflict between a master trust’s fiduciary responsibilities to its members and investment in the companies and infrastructure of the UK

-

News

NewsCurrent policy initiatives could be detrimental to UK’s productive finance agenda

Any attempt to force providers to invest more heavily in certain asset classes is a direct challenge to trustees’ fiduciary duty, says Pensions Policy Institute

-

News

NewsUK government, regulators prompt to clear way for long-term investment funds

A cross industry initiative has made several recommendations to increase investment in private capital