Real Estate – Page 2

-

Analysis

AnalysisAsian emerging markets on the rise

Investors are taking note of investment opportunities in Asia in a variety of different ways, as new research shows

-

Interviews

InterviewsEuropean pension funds on investing in their home market: a delicate balance

Pension funds in Europe have been reducing their allocation to European assets, especially listed ones. While valuations may be attractive, there is little else to convince them to raise their investments in their home market

-

News

NewsFinnish pensions reform seen widening equity allocations by 10 points

Ilmarinen and Varma say increased volatility is price worth paying for the higher return potential that newly agreed investment reforms allow

-

News

NewsThe People’s Pension targets £4bn private markets investment

The independent master trust aims to appoint a private markets specialist and to create a research capability, initially investing in infrastructure and real estate

-

News

NewsAlecta starts arbitration against Heimstaden, claiming agreement was breached

Swedish pension fund argues billionaire Ivar Tollefsen’s investments in new subsidiary went against Heimstaden Bostad shareholder agreement

-

News

NewsABP buys €2.7bn Dutch mortgage portfolio

Despite the large purchase, the fund will remain underweight mortgages compared to other Dutch pension funds

-

Analysis

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

News

NewsItaly’s CDC scheme to invest €1.1bn across equities, bonds, alternatives

The scheme will invest 72.4% of the €1.1bn planned for next year in bonds, 4.5% in equities, and 23.1% in illiquid alternatives, including real estate

-

News

NewsFidelity International to integrate private markets assets into default investment strategy

The circa 15% allocation by Fidelity’s FutureWise fund will be the first into its recently approved Long-Term Asset Fund

-

News

NewsNorway’s SWF recoups some green energy infrastructure losses in Q3

NBIM reports 4.4% return for GPFG between July and September, as falling interest rates propel stock markets

-

News

NewsVelliv says impact product revamp ‘in theory makes for better returns’

Danish mutual pension provider redesigns ideas behind VækstPension Aftryk, defines four categories of sustainable investment targets, adds asset classes

-

News

NewsSwedish pensions agency at odds with FSA over some Heimstaden Bostad facts

Pensionsmyndigheten says it ‘largely agrees’ with watchdog in its preliminary conclusions in case around agency’s blighted investment in residential property company

-

News

NewsSwedish Pensions Agency faces possible FSA intervention

Watchdog escalates probe into failing Heimstaden Bostad investments to a sanction case; director general Barr has to step back from case

-

News

NewsPeople’s Partnership makes investment move into UK market

The provider is in the process of developing in-house capabilities that are needed to invest in private assets

-

News

NewsAP3 takes firms to task over rising work fatalities in Sweden

Watered-down corporate climate plans are worrying the €47bn national pensions buffer fund, says sustainability chief

-

News

NewsProsecutor probes 10 counts of corruption in Alecta/Heimstaden Bostad case

Swedish pensions giant says it has not yet been part of the prosecutor’s corruption investigation, or received information about it

-

News

NewsAviva adds venture capital capability to rebranded private markets business

Latest move comes as Aviva Investors continues to expand its private markets offering to meet evolving demands of investors

-

Special Report

Special ReportTop 10 European pension funds raise equity and bond exposure

Pension funds in most European countries recorded strong returns of between 6% and 9%, according to preliminary figures published this summer by the OECD.

-

News

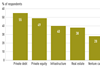

NewsInvestor negativity on real estate, private equity turns a corner – Preqin

Institutional investors had been outright negative about the prospects for the asset classes for the past two years