Top 1000 European Pension Funds 2025

Assets break the €10trn barrier for the first time

IPE’s exclusive Top 1000 European Pension Funds 2025 report marks a significant milestone for the industry: the first time collective assets under management have reached €10trn.

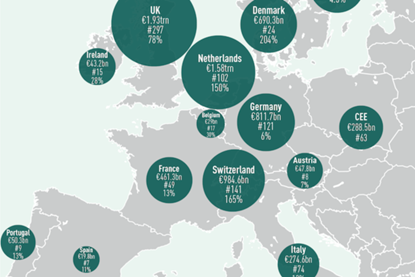

Over the whole of 2024, Europe’s pools of retirement savings grew for the second consecutive year, with overall AUM increasing by 6.2%, a rate of growth comfortably above the long-term trend, to hit €10.3trn. Over 10 years, the annual AUM increase for European pension funds stands at 5.4%.

IPE’s in-depth report reveals Portugal and Iceland as the two stand-out stars for 2024: recording - respectively - AUM growth of 23% and 19.7%. By contrast, Spain’s pension funds posted a 5.7% drop over the same period.

Several countries, including Austria, France and Italy, recorded an AUM increase of more than 10%.

Based on a sample of 100 pension funds taken from the overall list surveyed, allocation to alternatives fell slightly - by 3.6 percentage points - while those to fixed income, equities and real estate rose.

In recent years, the IPE research team has intensified its efforts in compiling and analysing data on European pension funds’ asset allocation. The expert team sourced data from national pension supervisory bodies, pension funds’ annual reports as well as those of published by sponsoring entities.

As well as a comprehensive analysis of the portfolios of the top 10 funds in AUM terms, we now provide an annual account of the asset allocation of 100 pension funds.

IPE Top 1000 2025: European pensions break €10trn barrier

Europe’s retirement savings pool grew by 6.2% in 2024, well above the 10-year average

Support data-driven decision-making. Access the Top 1000 European Pensions Dataset 2025

Download the complete 2025 survey dataset providing detailed information on 1000 European Pension Funds. Whether you are a pension fund wanting to know how you measure up against your peers, an asset manager building a business, or a service provider in this multi-trillion Euro sector - our data provides the most authoritative picture of pension assets across the continent.

More Top 1000 Pension Funds 2025

Top 1000 Pension Funds 2025 data

Europe’s pension funds grow above trend in 2024

Top pension funds asset allocation breakdown

IPE’s ranking of top pension funds with asset allocation data (%)

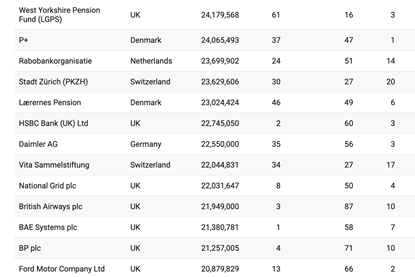

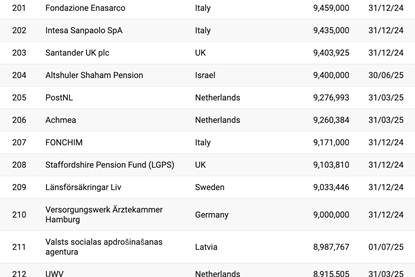

Top 1000 Pension Funds 2025 rankings

IPE’s ranking of leading pension funds by assets

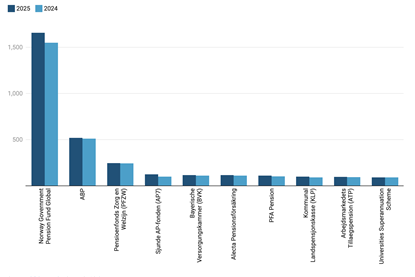

Top 10 European pension funds record 6% AUM growth

The assets held by the top 10 European pension funds grew 6% last year, according to IPE’s 2025 Top 1000 study.

EU pension reforms at a critical juncture

As efforts to reform Europe’s pension system gather pace, much will hinge on European Commission legislative proposals due out later this year

Denmark: Labour market pension fund in focus

An external review of ATP’s investment strategy gathers pace, and there have been calls for greater flexibility in contributions and payouts across the system as a whole

Finland: Pensions reform gathers pace in a bid to boost equities and returns

Finland’s pension system is in the midst of wide-reaching reforms, with draft legislation expected in 2026 and further changes targeting the self-employed

France: No well-intentioned pension reform goes unpunished

The collapse of France’s government has thrown the latest round of pension reforms into question – but second-pillar assets continue to grow

Germany: Restarting the pension reform process

The new government is picking up the slack to boost occupational and private pensions but the sustainability of the pay-as-you-go system remains in focus

Iceland: New pension bill stirs debate on disability payments

Draft amendment to the Pensions Act shifts the relationship between social security and disability pension payments

Ireland: National defined contribution pension scheme delayed once again

Ireland’s pension system is on the cusp of its biggest shake-up in decades, but uncertainty, inertia and governance gaps threaten to undermine it

Italy: Mandatory pensions on the cards for new labour market entrants

Government sees urgency in granting early retirement options but some representatives have put forward bold proposals for expanding supplementary pension coverage

Netherlands: Defined contribution transition under way as pension funds begin to sail in

Reforms to the Dutch pension system are finally under way with most funds set to move to the new system between 2026 and 2028

Norway: A sovereign wealth fund under scrutiny at home and abroad

Besides a review of its active management, Norway’s giant oil fund has come under fire over its investments in Israel

Spain: Pension policy in paralysis

Spain is nowhere near on track to enrol 13m of its citizens in occupational pensions over the next five years

Sweden: Pension reforms aim to reduce complexity and costs

The Swedish government is pressing ahead with further reform efforts ranging from simplifying basic security benefits to curbing opaque fund fees

Switzerland: Figuring out how to pay for the boomers

Switzerland is looking to bolster its first-pillar pension system, while revising ESG reporting both for Pensionskassen and corporates

UK: Government prioritises economic growth over pensions adequacy

The UK government has put pensions at the centre of its economic growth plans but while it is making haste with some measures, issues like pension adequacy have been kicked into the long grass

Previous Top 1000 Pension Funds

Top 1000 Pension Funds 2024: Pensions back at a sweet spot

Assets for the leading 1000 European pension funds grew by 8.7% year-on-year, reversing last year’s loss of 6.8%. This brings total assets back up to above their previous high water mark of €9.7trn in 2022’s research exercise. This year’s overall net gain in assets of €775bn is the largest since 2021’s increase of €810bn.

Top 1000 Pension Funds 2023: Europe’s pensions absorb a €646bn loss

Last year saw a net reduction in the asset stock of European pension investment retirement pools of 6.77% over the previous year, according to IPE’s annual study of the leading 1,000 pension funds across the continent, marking a sea change for pensions.

Top 1000 Pension Funds 2022: Pension assets increase reflects 2021’s markets

The assets of the leading 1000 European pension funds increased by well over €600bn in our latest survey – a large portion of which can be attributed to strong investment returns on the back of a sustained post-COVID rebound over the course of 2021.